[ad_1]

Despite my extensive experience of 13 years working in international equities, living abroad for the same duration, and visiting approximately 60 countries, I don’t allocate much of my investments to international stocks. I believe the risk outweighs the potential reward, especially when there are already numerous lucrative investment opportunities available in the United States.

If you’ve been experiencing some investing FOMO by not investing in international stocks, I say don’t worry about it. You haven’t missed much. If you’ve been wondering whether you should start investing in international stocks, I say it’s probably unnecessary.

This post aims to shed light on why investing in international stocks might be overrated, advocating for focusing mainly on U.S. stocks. Here’s a summary of the reasons behind this perspective:

- Abundance of U.S. stocks and other risk assets available for diversification purposes.

- Comfort and familiarity in investing in what one knows, understands, and can relate to.

- Challenges in valuing international stocks due to heightened corporate governance and geopolitical risks.

- Limited availability of best-in-class companies with varying accounting standards outside the U.S.

- Difficulty in predicting which international stocks or countries will outperform.

- There already plenty of potentially profitable investments to choose from in America.

Performance Of International Stocks Versus Domestic Stocks

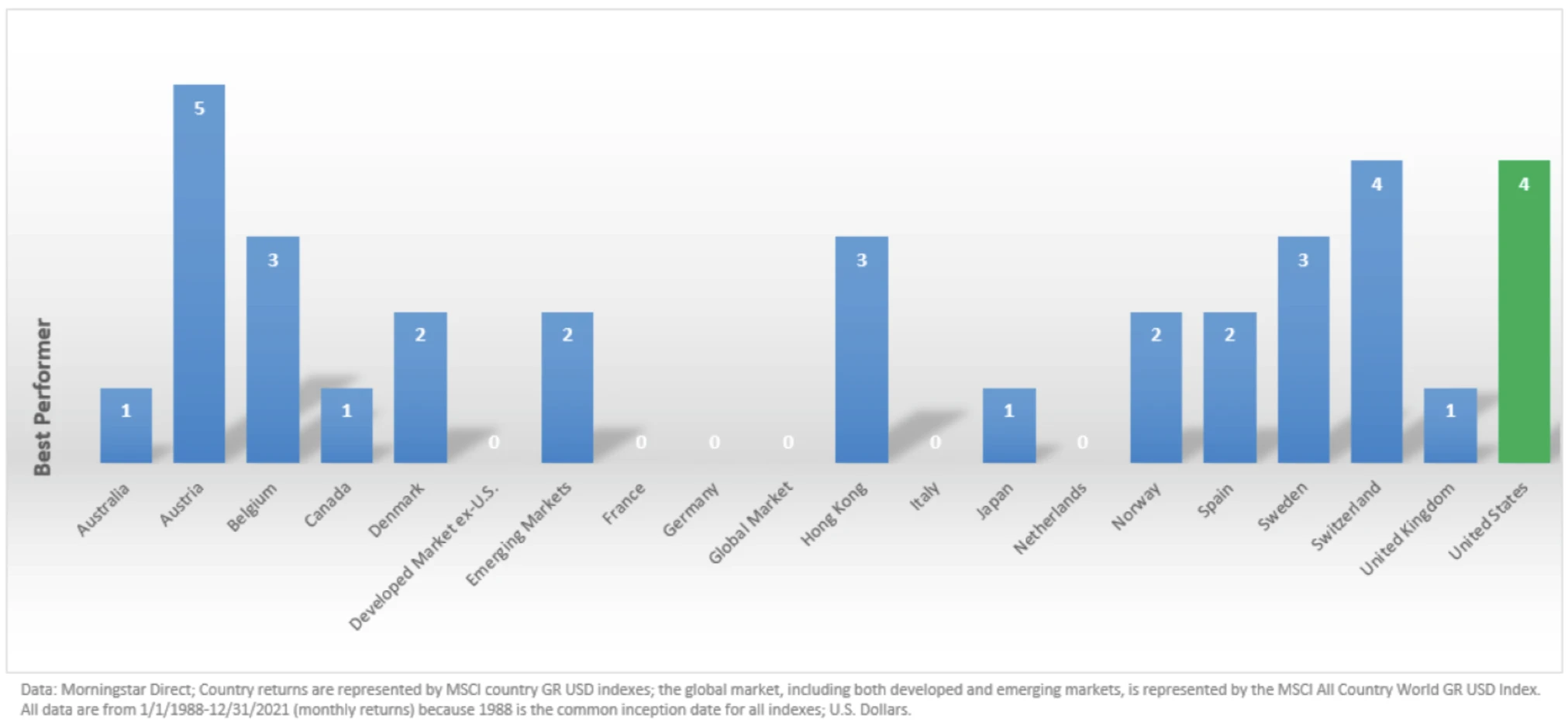

Below is a 2021 graph provided by Morningstar that illustrates stock market returns since 1988. Surprisingly, the United States has only been the top performer four times during this period. In contrast, Austria has claimed the top spot five times, while Switzerland has matched the United States’ performance four times.

This data suggests that solely investing in U.S. stocks may have resulted in underperformance compared to international stocks. However, is it so bad to come in second or third with strong gains? I don’t think so and this data doesn’t go into further detail.

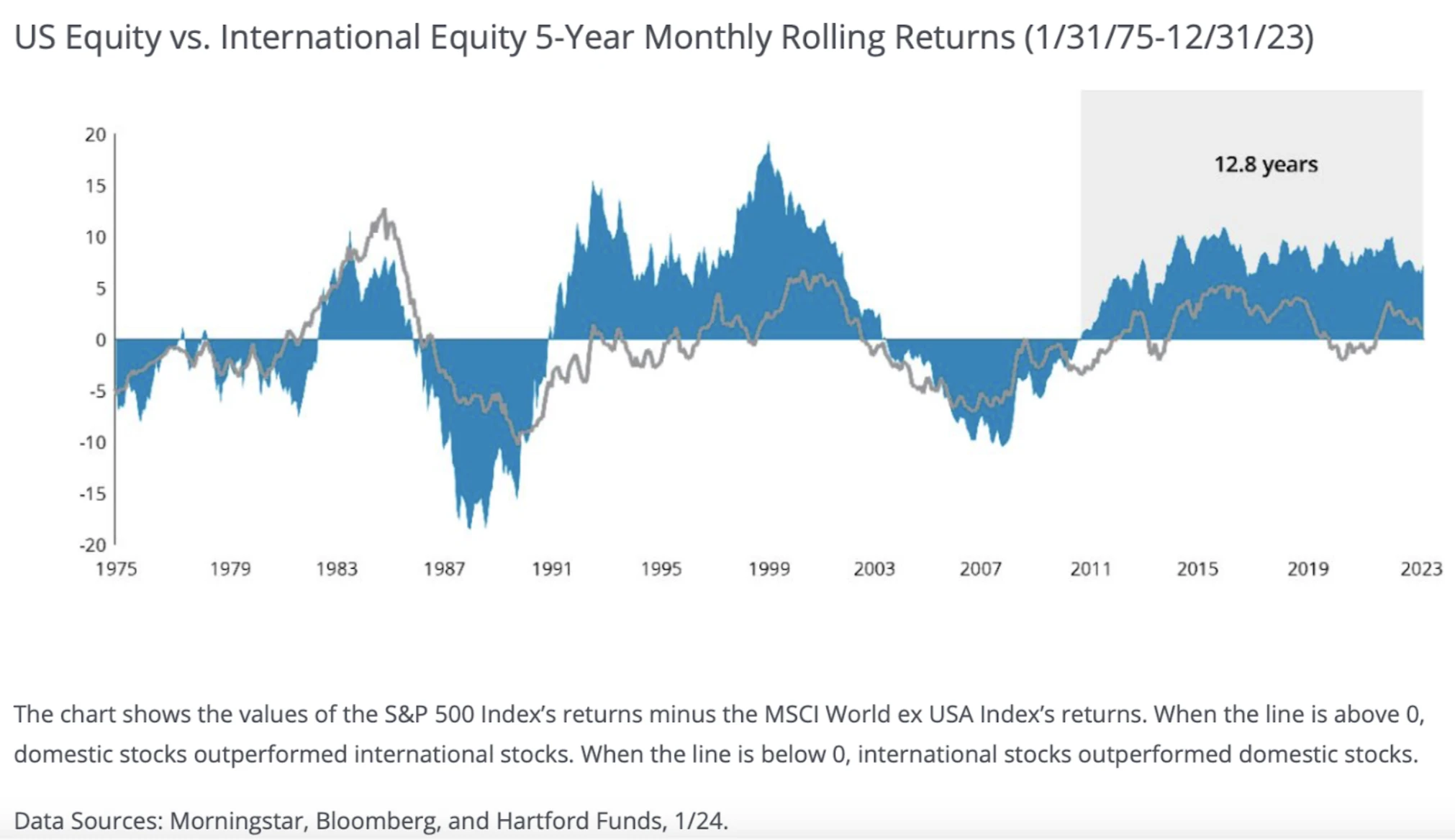

Below is a chart compiled by the Hartford Funds, utilizing data from Morningstar and Bloomberg as of 12/31/2023. It illustrates that the S&P 500 underperformed international stocks during the 1970s, the late 1980s, and from 2003 to 2011. However, it also demonstrates that the S&P 500 has outperformed international equities for the past 12.8 years.

Challenges in Consistently Identifying Outperforming International Stocks

The charts above demonstrate that U.S. stocks do not always outperform international counterparts. Hence, having international stocks can serve as a hedge against potential underperformance of U.S. stocks.

However, two significant challenges arise with this approach.

1) Uncertainty in Timing and Duration of Outperformance

Determining when and for how long international stocks will outperform U.S. stocks poses a challenge. For instance, in 2011, investing 40% of a portfolio in international stocks might have seemed prudent due to their lower debt burden, which outshone U.S. stocks during the 2008-2009 financial crisis. Yet, this strategy would have led to a 13-year period of underperformance compared to investing solely in the S&P 500.

Similarly, increasing exposure to international stocks now, given their 13-year underperformance, might seem logical. U.S. stocks can’t outperform international stocks forever, can they? However, predicting a mean reversion where the S&P 500 begins to lag is uncertain.

Coming out of COVID, the U.S. showed it was a world-leader in navigating through a crisis. Now, many international investors are looking to overweight the U.S. as a result.

2) Uncertainty in Identifying Outperforming International Stocks or Countries

Determining which international stocks or countries will outshine the U.S. market adds another layer of complexity.

For instance, heavily investing in Hong Kong stocks due to their decline since COVID-19 might seem appealing. Yet, ongoing challenges stemming from China’s policies and property overbuilding could perpetuate Hong Kong’s struggles.

Conversely, France, Germany, and Italy might outperform due to favorable factors such as a competitive currency, lower inflation prompting quicker rate cuts, and stronger corporate and government balance sheets.

Introducing international stocks into a portfolio introduces myriad variables to consider. Alternatively, why not invest in the S&P 500 and select individual growth stocks that you believe will outperform? There’s no need to venture to international stocks where you have little-to-no understanding.

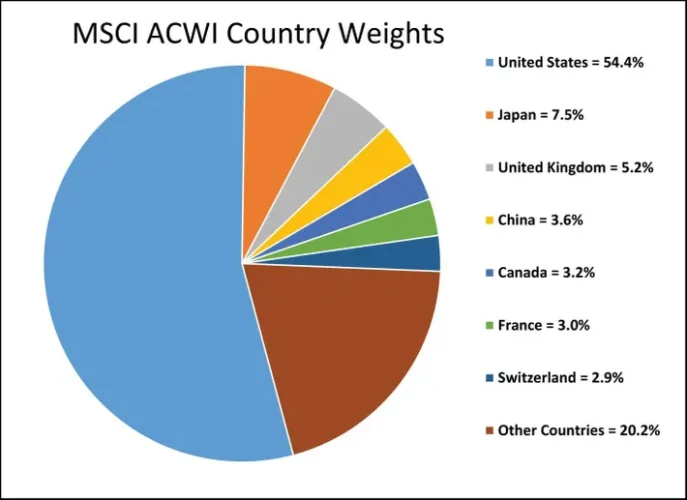

One of the standard international stock indices is the MSCI All Country World Index. You can invest in it through the ETF, AWCI, to access international stock exposure alongside majority U.S. stock exposure, as depicted below.

Below is the performance of the ACWI since 2009. Not too bad with a 22.3% return in 2023.

But when you compare ACWI to SPY, an S&P 500 ETF, you can see the significant underperformance over the past five years. The thing is, there are a plethora of international ETFs to choose from. How do you know which one to choose that’s best for you? You don’t.

International Stocks Offer Pure-Play Exposure

Instead of opting for a knock-off “Bolex” watch from a dubious street market in New York City, you might prefer the authentic Rolex from Geneva, Switzerland. While the genuine Rolex may come at a higher price, it offers quality and durability commensurate with its value.

Numerous international countries produce exceptional products. Examples include Louis Vuitton handbags from LVMH, semiconductor chips from TSMC, and automobiles from BMW. Restricting oneself to domestic investments could mean missing out on significant growth opportunities abroad.

Don’t worry because there are two solutions if you want to gain international exposure.

Buy American Depository Receipts (ADRs) of International Stocks

Instead of investing in an entire international market through an ETF, one can opt for the ADR of a preferred international stock. Many major international companies, although not all, offer ADRs. For instance, TSMC’s ADR is TSM, LVMH’s ADR is LVMUY, and BMW’s ADR is BMWYY.

Picking and choosing specific international stocks to round out your portfolio may be a better decision.

Sufficient International Exposure Among U.S. Companies

For exposure to international stocks, you could also consider investing in leading U.S. multinational corporations like Chevron, Pfizer, and Apple. These companies derive at least 25% of their revenue from overseas markets, capitalizing on increased demand abroad. For instance, if iPhone sales surge in China, Apple stands to benefit.

However, U.S. multinational companies typically specialize in specific sectors such as technology or healthcare. Relying solely on U.S. multinationals may limit diversification across various industries.

The Main Risks Of Investing International Stocks

International stocks may seem attractive on any given year, however, it’s important to be aware of all the risks associated with investing internationally.

Geopoliticial Risk

Living abroad or investing in international stocks provides a perspective on the stability of the U.S. government in comparison.

As a global superpower, neither Canada nor Mexico would dare to attack the U.S. Moreover, being a country with a global reserve currency results in less currency and capital account volatility. Our functioning democracy has thus far prevented military coups, making the United States one of the most stable countries globally.

Geopolitical stability is crucial for investors. Investing in assets prone to numerous unknown external factors can be risky. For instance, when Russian President Putin invaded Ukraine, the Russian stock market plummeted by 39% in a single day. The Russian ruble also hit record lows as citizens rushed to convert their currency into other more stable ones like USD.

Assessing non-company fundamental risks is challenging for investors. Determining whether to pay a 10%, 20%, or 70% discount for an international company stock relative to its U.S. peers is complex and uncertain. If you can’t predict a risk, then you might as well not invest at all.

Currency Risk

If the local currency weakens in comparison to your home currency, your returns may diminish when converted back to U.S. dollars.

For instance, let’s consider purchasing a Chinese tech company where one U.S. Dollar buys 7.24 Chinese Yuan. All seems well until the Chinese government decides to invade Taiwan, causing a sharp depreciation of the Chinese Yuan to 15 per one U.S. Dollar as investors flee Chinese Yuan-denominated assets. In such a scenario, you would incur a significant loss in your company’s earnings when converting them back to U.S. Dollars.

Similarly, if you invest in Apple stock, you could be adversely affected by a substantial devaluation of the Chinese Yuan, given that almost 20% of Apple’s revenue comes from China. The conversion of Chinese Yuan profits back to U.S. Dollars would significantly impact Apple’s next quarterly earnings report.

S&P 500 Companies With High Foreign Revenue Exposure Underperformed In A Bear Market

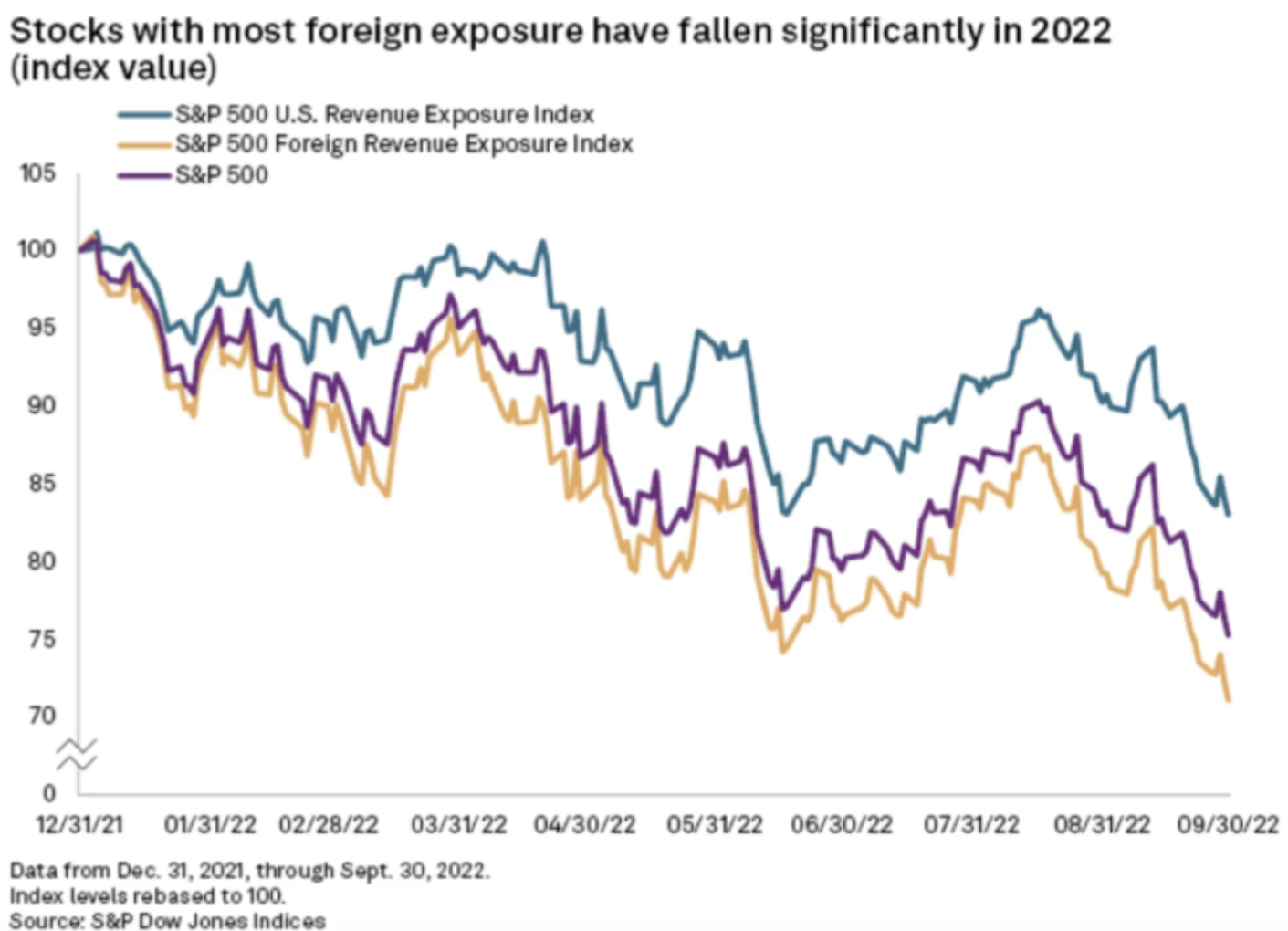

The chart below illustrates how the S&P 500 Foreign Revenue Exposure Index (represented by the gold line) experienced a more pronounced decline than the S&P 500 Index (represented by the purple line).

During the 2022 bear market, where the S&P 500 fell by 19.6%, the S&P 500 Foreign Revenue Exposure Index fell even further. This decline coincided with the beginning of the Fed’s aggressive 11 rate hikes in 2022. As U.S. interest rates rose, so did the value of the U.S. Dollar, as U.S. assets became relatively more attractive.

S&P 500 Outperformed MSCI ACWI In 2023

Now, let’s examine the performance of the S&P 500 compared to the MSCI All Country World Index (ACWI) during the 2023 bull market. The S&P 500 outperformed the ACWI by more than 10%. When an asset class allows you to minimize losses during downturns while maximizing gains during upswings, it becomes an appealing investment option.

Economic Risks

In relative terms, the United States boasts a stable economy. Since 1960, the GDP growth rate has fluctuated modestly, ranging from -2.5% to +7.5%. Additionally, with the exception of 2022, inflation has remained relatively stable, fluctuating between 1% and 4% for decades.

Now consider Argentina as an example. Its governmental policies have led to hyperinflation, resulting in economic instability, soaring unemployment rates, and substantial real financial losses.

Over the past 42 years, Argentina’s consumer price inflation rate has fluctuated dramatically, ranging from -1.2% to a staggering 3,079.8%. In 2022, the inflation rate reached 94.8%, while by November 2023, it surged to 160.92%.

From 1980 to 2022, the average annual inflation rate in Argentina stood at 206.2%, with prices soaring by an incredible 902.38 billion percent overall. To put it into perspective, an item that cost 100 pesos in 1980 would have skyrocketed to 902.38 billion pesos by early 2023.

Investing in such an environment presents significant challenges and risks. Why bother?

Lower Market Liquidity With International Countries

Most international markets have lower liquidity compared to major domestic markets. As a result, any type of geopolitical risk could cause much greater downside movement as investors head for the exit doors.

The New York Stock Exchange, for example, is about four times bigger than the Japan Exchange Group, and 25 times bigger than the Brazilian stock exchange in terms of market capitalization of companies. Larger stock exchanges provide more liquidity and better buffers during difficult times.

Below is the estimated market capitalizations of the world’s top 20 stock markets. Notice how the NYSE and Nasdaq dwarf all other international stock markets.

Now zero in on the Taiwan Stock Exchange with an estimated $1.6 trillion market capitalization. Not only is the Taiwan Stock Exchange about 93% smaller in size than NYSE, Taiwan Semiconductor Manufacturing accounts for between 35% – 40% of the country’s entire market capitalization! Talk about concentration risk.

Instead of buying the Taiwan Stock Exchange, you could just buy TSM instead.

International Corporate Governance Standards May Be Lower

When investing abroad, corporate governance criteria might not conform to the standards anticipated by U.S. investors. This encompasses elements like shareholder privileges, openness, responsibility, board efficiency, risk mitigation, shareholder engagement, and adherence to regulations.

In the United States, there’s all sorts of rules and regulations, such as the Sarbanes-Oxley Act to prevent corporate fraud. We talked about this when I was able to connect the dots with a private growth company’s plans to go public.

Publicly traded companies in the U.S. most report earnings every quarter, and such reports must be publicly disclosed all at the same time. Other international stock market exchanges may have different reporting standards.

Sure, in America, we have had scandals with big names such as Enron, Worldcom, and FTX. However, the frequency of our corporate governance scandals are fewer compared to the ones in international markets. And if one is happening, as an international investor, you might be the last to know.

Some recent international stock market scandals:

- Volkswagen Dieselgate: In 2015, Volkswagen admitted to installing illegal software in millions of diesel vehicles worldwide to cheat emissions tests. The scandal resulted in a massive drop in Volkswagen’s stock price, significant fines, and reputational damage for the company.

- Wirecard: Wirecard, a German payment processing company, collapsed in 2020 following revelations of accounting irregularities. It was discovered that the company had overstated its revenue and assets by billions of euros. The scandal led to Wirecard filing for insolvency and numerous investigations into fraud and misconduct.

- Satyam Computer Services: Satyam, one of India’s largest IT services companies, was embroiled in a massive accounting scandal in 2009. The company’s founder admitted to inflating profits and falsifying accounts to the tune of over $1 billion. The scandal severely impacted investor confidence in India’s corporate governance standards.

Global And U.S. Market Drawdowns

In two charts above, you saw how the S&P 500 fared against international stocks during a bear market in 2022 and a bull market in 2023. The S&P 500 outperformed both years.

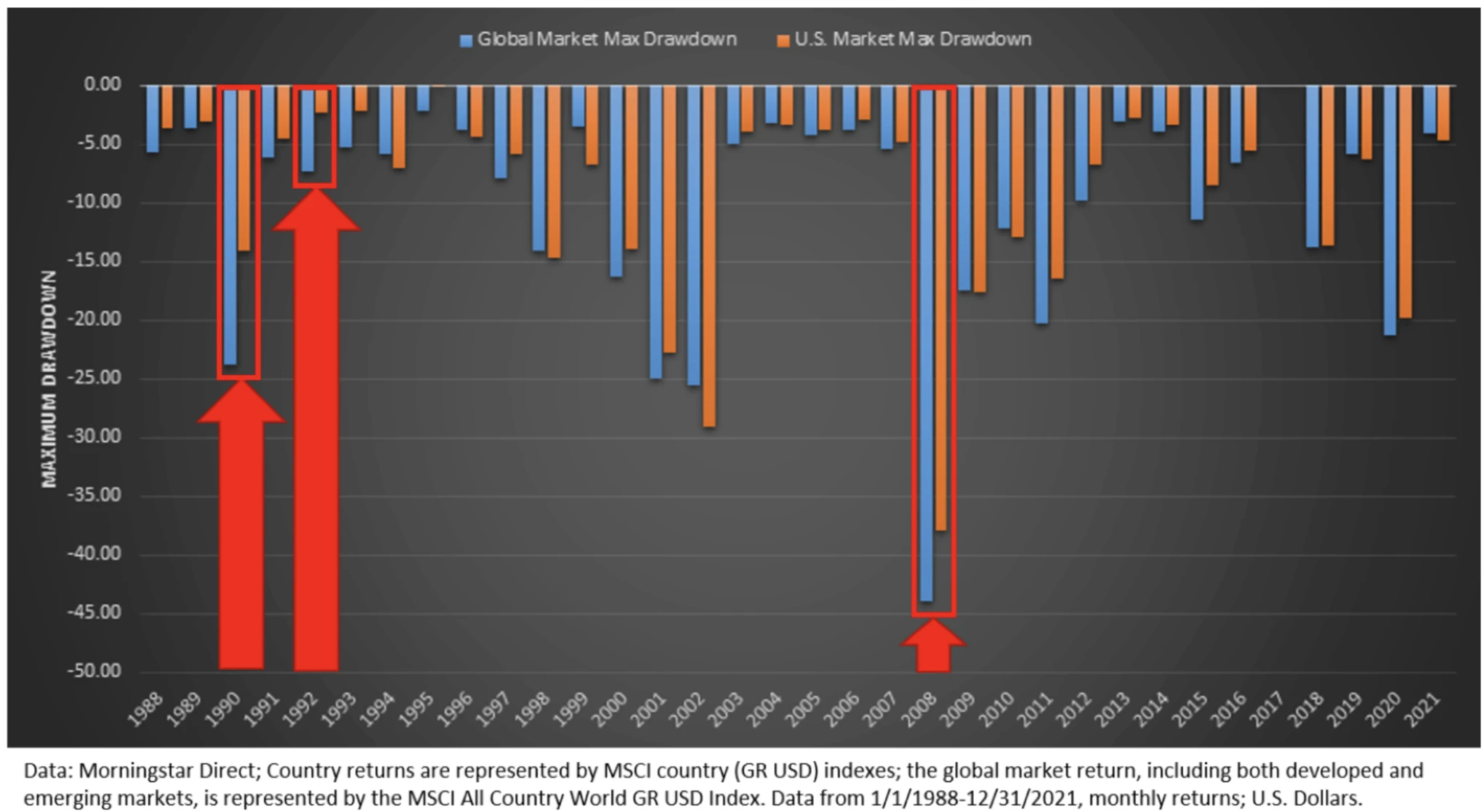

Now let’s zoom out further to see the historical downside risk of investing in international stocks and domestic stocks. The blue represents international stocks and the orange represents the U.S. market.

Notice how the drawdown in international stocks has historically been much greater than the drawdown in the U.S. market. The main reason why is because during a global bear market, there tends to be a flight to developed countries with more financial stability.

A local analogy would be selling your unnecessary vacation property before you sell your primary residence. In this analogy, the vacation property is international stocks because you don’t need them. As a result, vacation property valuations and international stock valuations tend to suffer the most during downturns.

How Much International Stocks To Hold In Your Portfolio

Based on my arguments above, you might agree that owning international stocks in your portfolio is unnecessary. There’s too much risk and not enough reward. You could allocate 0% of your portfolio to international stocks and do just fine. Besides, U.S. multinational corporations already provide international exposure with better corporate government.

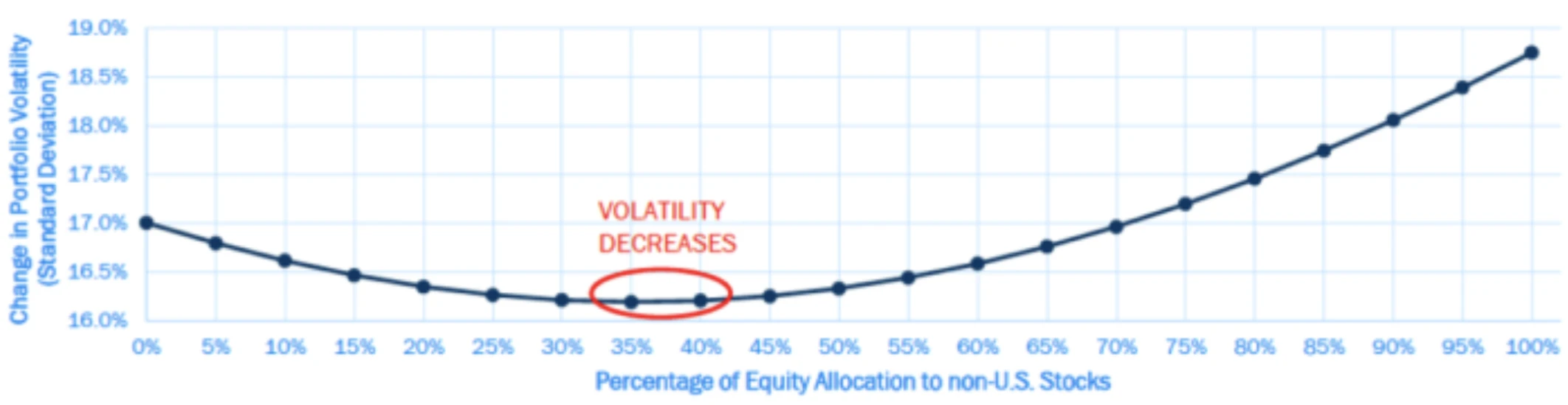

One method to determine the appropriate level of international stock exposure in your portfolio is through Modern Portfolio Theory (MPT). MPT advocates for a strategy that involves investing across the global market, with each asset class weighted according to its market capitalization. Since the U.S. market makes up roughly 60% of the global market, MPT suggests that a U.S. investor should allocate approximately 60% of their portfolio to U.S. stocks and the remaining 40% to non-U.S. stocks.

This approach provides a balanced perspective on the allocation of international stocks in a portfolio. By incorporating international stocks into a portfolio primarily composed of U.S. assets, MPT aims to potentially reduce volatility. Historical data suggests that optimal diversification occurs when non-U.S. equity constitutes between 35% and 40% of the total equity exposure, indicating a potential point of minimal portfolio risk.

But here’s the thing, MPT is a suggestion that hasn’t played out since 2011. If MPT was the truth, then everybody would follow it and all be mega rich!

Related: Investments Strategies For Retirement Based On Modern Portfolio Theory

Why Not Just Own Stocks In The Best Country Instead?

Drawing from my extensive experience living abroad and working in international markets, I hold a strong conviction that the United States stands as the preeminent country for wealth accumulation. Despite not having the world’s largest population, America hosts the majority of the globe’s most valuable companies for good reason.

The unparalleled corporate governance, innovation, technology, work ethic, and ingenuity exhibited by Americans set them apart. Consequently, I prefer investing in the world’s top innovators and operators rather than venturing into international stocks where my understanding may be limited or lacking.

Yes, I am undoubtedly displaying home country bias, which involves a desire to allocate a higher proportion of one’s public investment portfolio to U.S. stocks than the U.S. market capitalization weighting in the global market. However, I also logically believe that if I’m to invest in a risk asset, I might as well invest the most in the best country.

Diversity is commendable for societal reasons. But when it comes to maximizing financial returns, the focus should be on investing in the best people working at the best companies, which are headquartered in the best country in the world.

I acknowledge that this viewpoint may be perceived as arrogant. However, it only seems prudent to allocate a greater portion of capital to America given its track record and potential for generating superior returns.

But International Stocks Are Cheaper! (For A Reason)

Yes, many international stocks may appear cheaper compared to their counterparts and stock markets in the United States. However, these lower valuations often reflect underlying risks, with corporate governance being a primary concern.

For instance, Alibaba is often likened to the Amazon of China. However, Alibaba trades at a fraction of Amazon’s valuation due to corporate governance and geopolitical issues. The Chinese government has taken a firm stance against its founder in the past for being too vocal, leading to setbacks such as the shelving of its Ant Financial subsidiary’s IPO.

Shown below is a depiction of Alibaba’s free cash flow (orange) alongside its share price. Despite a significant rebound in free cash flow in 2023, BABA’s stock remains lackluster due to factors like a slowing Chinese economy, corporate governance concerns, and uncertainty regarding government actions.

BABA looks like a BUY to me. But it could also be a value trap, one in which I’ve been trapped and starved to death before. Many international stocks are cheaper for a reason. Beware.

Differentiating Between Developed International vs. Emerging Markets

As I mentioned above, there is the MSCI AWCI (ETF: AWCI), which is an index of developed international markets. Then there is the MSCI Emerging Markets Index (ETF: EEM), which consists of “developing” international markets.

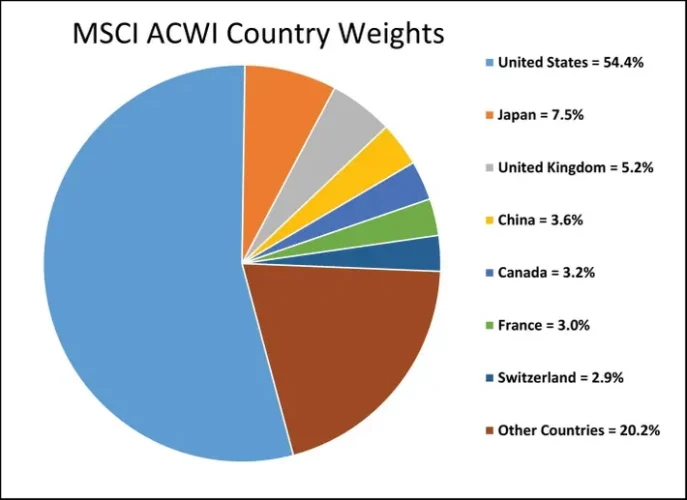

MSCI ACWI Country Weightings

Developed markets are characterized by robust infrastructure, mature capital markets, and elevated living standards. These markets are chiefly found in North America, Western Europe, and Australasia, encompassing nations such as the United States, Canada, Germany, the United Kingdom, Australia, New Zealand, and Japan.

In other words, a group of people at MSCI somewhat arbitrarily decided which countries are considered developed and what their weightings in the index will be. Now the MSCI ACWI is a standard index many developed country international funds follow and try to outperform.

Emerging markets are experiencing rapid expansion and development, yet they feature lower household incomes and less developed capital markets compared to their developed counterparts. These markets are characterized by swift economic growth alongside weaker infrastructure and reduced household incomes.

Currently, emerging markets include the “BRIC” nations (Brazil, Russia, India, and China), along with Portugal, Ireland, Italy, Greece, and Spain. For investors seeking higher-risk opportunities, investing in emerging markets may hold greater appeal. The acronym “BRIC” was coined by a Goldman Sachs economist.

MSCI Emerging Markets index composition

Invest In Emerging Markets Is Even Riskier

You might find investing in the MSCI Emerging Markets Index appealing when you consider its composition. China and India, both experiencing rapid growth, stand as significant international competitors to the United States. Additionally, countries like Brazil, Poland, Mexico, the Philippines, and Thailand show considerable promise in terms of growth potential.

However, if you had invested in the MSCI Emerging Markets Index back in 2009, over fifteen years later, you would have experienced a loss. Can you imagine taking on all that international exposure risk, only to significantly underperform the returns of an average checking account? Once again, the cheap valuations of international stocks and countries often reflect underlying reasons.

EEM = Purple line

Don’t Need To Invest In International Stocks

You can explore international stocks through ETFs like EEM, ACWI, and many others. You can buy country-specific ETFs and ADRs. These investments have the potential to mitigate your portfolio’s volatility and yield higher returns over time. However, there’s also the possibility that investing in international stocks could hinder performance.

Considering the plethora of options available in the American market—including stocks, bonds, real estate, and alternative investments—you may find little necessity to delve into international investments that you’re not fully acquainted with.

Much like how many seek to migrate to America for a better life, a significant portion of international capital seeks to invest in American stocks. If you have the opportunity to live and invest in one of the top countries globally, why bother looking elsewhere? There’s is plenty of fortunes to be found right here in U.S.A.

Reader Questions And Suggestions

How much of your portfolio is in international stocks? How have they done for you? Why do you invest in international stocks if there are already so many high-quality American stocks to own? Do you think investing in international stocks is worth it?

To diversify your U.S. stock portfolio, you can simply add Treasury bonds, corporate bonds, and real estate. Real estate is my favorite asset class to build wealth becomes it provides utility, is less volatile, and generates income.

Check out Fundrise, a leading private real estate platform today with over $3.3 billion in assets under management. Fundrise invests predominantly in residential and industrial properties in the Sunbelt region, where valuations tend to be lower and yields tend to be higher. Fundrise is a sponsor of Financial Samurai and Financial Samurai is an investor in Fundrise.

Personally, I’m enthusiastic about investing in private artificial intelligence (AI) companies for the next decade. AI is poised to revolutionize the future, and I prefer allocating a portion of my investments to AI rather than international stocks. Explore the Innovation Fund, an open-ended venture fund offering the opportunity to invest in top AI companies for just $10.

To expedite your journey to financial freedom, join over 60,000 others and subscribe to the free Financial Samurai newsletter. Financial Samurai is among the largest independently-owned personal finance websites, established in 2009. Financial Samurai is an investor in Fundrise and Fundrise is a long-time sponsor of Financial Samurai.

[ad_2]

Zita boo

Interesting