Want more stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the free, daily ResiClub newsletter.

Earlier this year, a friend of mine saw the monthly home insurance and property taxes on his Fort Lauderdale, Florida, rental property, which he bought during the pandemic frenzy, increase by $500 per month. It cut his cash flow in half.

He isn’t alone: The average U.S. home insurance premium rate rose 11.3% in 2023, according to S&P Global. That was double the 6.6% increase in 2022 and far above the pre-pandemic increases in 2018 (+3.2%) and 2019 (+2.5%).

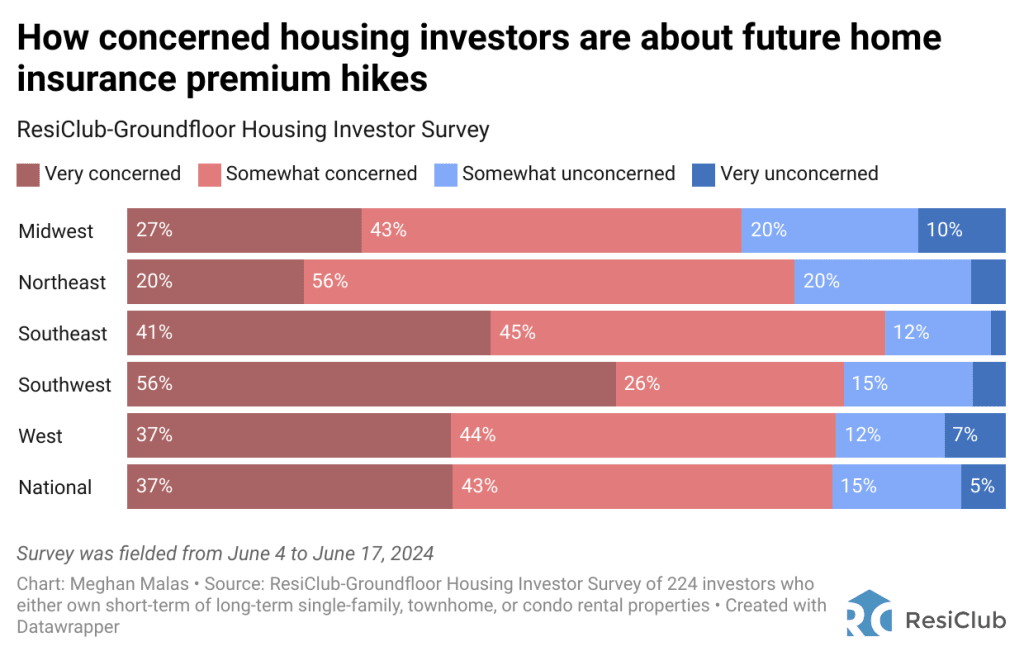

Among the landlords polled in the ResiClub-Groundfloor Housing Investor Survey conducted this month, 80% said they’re concerned about future increases in home insurance. Of those, 37% are “very concerned.”

Home insurance premiums have been increasing faster in coastal states, particularly around the Gulf, with the average Texas homeowner experiencing one of the largest increases last year (+20.3%). That said, these increases are happening far beyond the coast. According to ResiClub’s reporting, the rise in home insurance premiums is due not only to climate risk but also to housing and construction inflation. Replacement and repair costs have soared, and insurers are trying to keep up, although some state insurance commissions are slowing the process.

Even homeowners in Indiana and Iowa saw their average home insurance premium rates rise by 12.2% and 13.5%, respectively, in 2023.

That explains why the ResiClub-Groundfloor Housing Investor Survey found that investors across the country, including the Midwest, are concerned about the prospect for rising home insurance premiums.