[ad_1]

A cycle of interest rate cuts could start as soon as September, according to comments Friday by Jay Powell, the chairman of the U.S. Federal Reserve: “The time has come for policy to adjust,” Powell said.

After more than two years of elevated rates, the hotel industry is optimistic that cuts could spark a rush to negotiation tables, speeding up acquisitions, hotel development, and refinancings.

“A Fed rate cut cycle could help stabilize the economy, which would be a boost to both consumer and business sentiment,” said Seth Borko, head of research at Skift Research.

Here are 9 likely impacts on the hotel sector.

1. A Boom in Hotel Asset Sales

An interest rate cut in September will be positive for the market in two respects, according to Kevin Davis, group Americas CEO at JLL Hotels & Hospitality, an investment advisory firm that has helped trade more than $83 billion in hotel assets in the past five years.

“First, it will improve the investment return math,” Davis said. “Second, and perhaps more importantly, it will improve investor psychology, leading to a greater willingness to buy and sell assets.”

Any additional cuts later in the year could “significantly jumpstart investment activity,” he said.

Last year, global hotel transactions hit their second-lowest volume in a decade. Only the 2020 pandemic year was worse, according to JLL.

High interest rates have prompted many buyers and sellers to wait. Dealmakers signed only $50.5 billion of hotel transactions last year, compared with $77.8 billion in 2019.

“We certainly hope and anticipate that the rate cut will result in more hospitality transactions that pencil and provide a small measure of relief to existing owners with floating rate loans,” said Mark Rutter, attorney, at the global hospitality and leisure practice group at law firm Paul Hastings.

Some investment analysts speculate that in-play assets could include Marriott International’s 20 remaining hotels, which it would like to sell to become as asset-light as possible.

2. Cha-Ching for Hotel Owners and Investors

Lower interest rates can lead to lower debt servicing costs, which can benefit the bottom line of a hotel operator.

A case in point: Apple Leisure Group, a real-estate investment trust that owns about 225 hotels, estimated earlier this year that an interest rate cut of 1 percentage point (100 basis points) would boost its annual net income by $1.5 million a year.

That gain to its bottom line would be representative of what many hotel asset owners would enjoy.

One caveat: Gains from lower interest rates may be partly offset by rising operational costs elsewhere. Record-high property insurance costs, partly due to extreme weather caused by climate change, have pinched hotel cash flows, primarily in top gateway markets, said CBRE Research.

3. Build, Baby, Build

On the construction side, the higher cost of financing has kept many hotel developers on the sidelines in North America and Europe.

First, construction costs spiked because of labor and supply chain disruptions. Then inflation drove up the cost of materials, and rising interest rates made loans costlier, deterring investment.

Greenlit projects have generally been backed by well-capitalized investors, most commonly in the Middle East and parts of India.

“A Fed rate cut could help spur a new round of hotel construction,” Borko said.

According to Lodging Econometrics, 15,196 hotel projects (2.36 million rooms) were in signed development worldwide as of June 30. Lower interest rates would accelerate the conversion of those plans into open hotels.

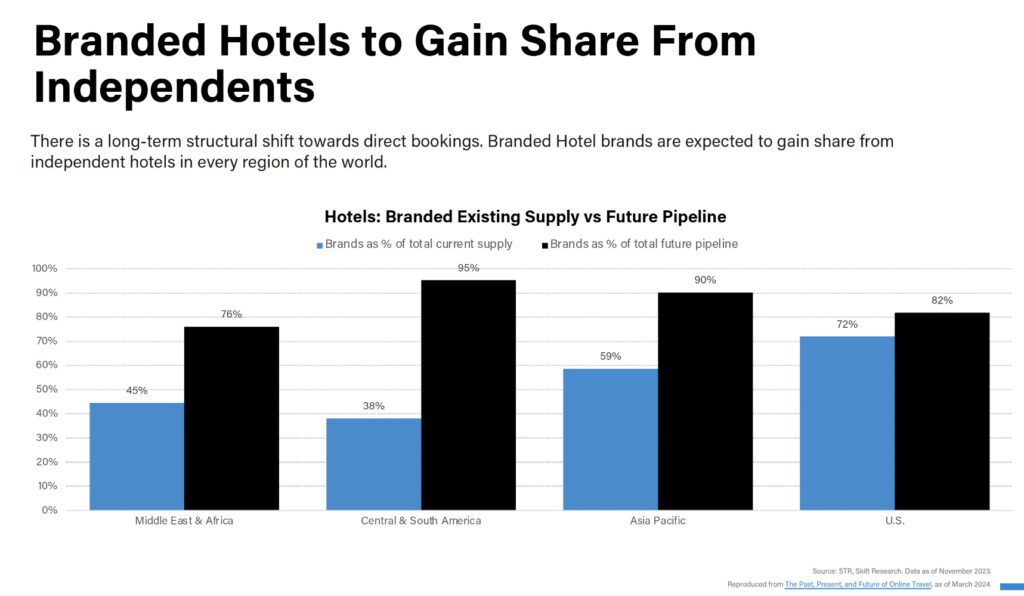

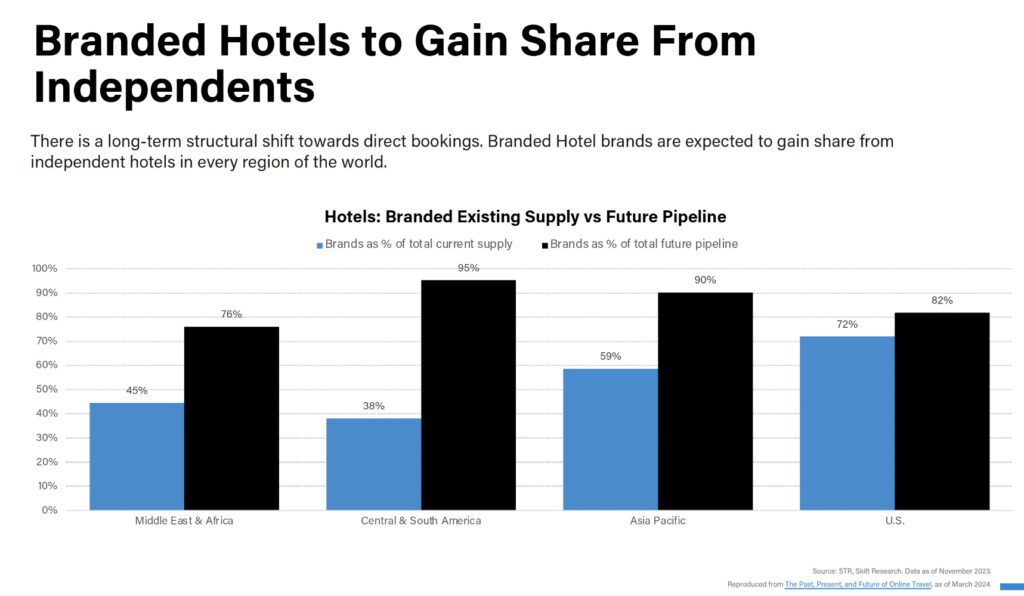

“New hotel construction tends to be branded rather than independent,” Borko noted.

4. More Musical Chairs for Hotel Brands

Interest rates have also slowed dealmaking for existing properties, not just new construction.

“That’s important because ownership changes create prime opportunities for brands to add properties,” Borko said. “One of the most common times for hotels to ‘re-flag’ to new brands is when properties change hands.”

The following chart from Skift Research’s State of Travel 2024 deck illustrates the momentum that hotel groups enjoy — which interest rate cuts could fuel.

5. More Resilient Traveler Demand

Interest rate cuts may also have a few broader effects that boost the hotel industry, such as encouraging consumers to continue spending on trips.

Some impacts may be direct on consumers, such as the cost of loan servicing dropping, and free up cash for spending on travel. Other impacts may be indirect, such as consumers feeling a wealth effect from rising stock prices or home valuations.

“We have already seen recessionary concerns pop up around market sell-offs,” Borko said. “The travel industry is certainly not recessionproof but may be more ‘recession resistant’ than in past cycles.”

6. More Short-Term Rental Competition in Some Markets

In a handful of markets, short-term rentals have recently emerged as competitors to hotels. In the second quarter in the U.S., short-term rental demand was 32% above 2019 levels, while hotel demand was 1% below 2019 levels, according to CBRE Research.

Some of the most resilient short-term rental markets are mid-sized cities experiencing economic and population growth, according to AirDNA.

A drop in interest rates could ease the pressure on managers of short-term rentals that aren’t hosts in their primary home by reducing monthly mortgage costs. Some people trying to create Airbnb or Vacasa empires have gotten underwater on their mortgages because of a run-up in interest rates and demand “normalizing” at a lower level after a pandemic boom.

A Fed rate cut could throw these operators a lifeline by lowering their borrowing costs. However, it may only delay the inevitable reckoning for properties that are no longer economically viable.

7. More Sales of Branded Residences

Many hotel companies have branched into selling branded residences, where hotel-style amenities are offered in a residential setting, often as condominiums.

A drop in mortgage rates could boost demand for such inventory, including from international investors looking to invest in real estate outside of their home markets if their home country’s stock markets or economies are underperforming.

8. Troubled Hotel Owners Get a Breather

Lower interest rates may also relieve pressure on some owners and investors who have struggled to pay their debt service.

The most famous recent example of distressed assets is the two San Francisco hotels that Park Hotels & Resorts, an operator, stopped making payments on a $725 million loan a year ago. It lost the two hotels, Hilton Union Square and Parc 55, which make up 9 percent of the city’s hotel rooms, reported The Real Deal.

Other owners and investors whose properties face continued difficulties may get some relief from lower interest rates.

Persistently high interest rates have exacerbated financial stress for many hotel owners and investors facing impending debt maturities.

JLL has estimated that about $2.2 billion of “institutional quality loans” for “higher-quality assets in prime locations” will come due in the next five years, and a more favorable interest rate environment may unlock dealmaking.

9. More Timeshare Sales

It’s fairly self-explanatory that lower interest rates ought to translate into more demand for vacation ownership, as companies will be able to offer cheaper terms on contracts.

Many of the large hotel groups receive licensing fees for lending their brand name to timeshare operators. So, they could benefit from resilience in the timeshare segment.

Accommodations Sector Stock Index Performance Year-to-Date

What am I looking at? The performance of hotels and short-term rental sector stocks within the ST200. The index includes companies publicly traded across global markets, including international and regional hotel brands, hotel REITs, hotel management companies, alternative accommodations, and timeshares.

The Skift Travel 200 (ST200) combines the financial performance of nearly 200 travel companies worth more than a trillion dollars into a single number. See more hotels and short-term rental financial sector performance.

Read the full methodology behind the Skift Travel 200.

[ad_2]