[ad_1]

Options trading offers interesting opportunities to educated and savvy investors, with the potential to profit from swings in market prices and other strategies can help protect yourself from losses if an investment strategy doesn’t pan out as expected.

But that’s not all you can learn from options trading. By reviewing options trading data, you may be able to spot irregular activity by other traders, giving you critical insights into what others may be thinking and expecting.

Here’s a closer look at how you can hunt down and keep track of unusual options trading activities to give you a potential leg up when making your next option trade.

Thanks to investment platform moomoo for making this article possible. You can learn more about what you can do with moomoo in our full in-depth moomoo review.

Get started with moomoo to earn a “Mag 7” fractional share bundle with a qualified deposit or 1.5% Cash Reward match ($300 max) on Transfers. Terms & Conditions apply >>

What Is Unusual Options Activity?

To understand what constitutes unusual options activity, you must filter out superfluous information and hone in on the market data that matters most. According to NASDAQ data, about 40 million options contracts trade daily. That makes it easy to get caught up in the minutiae and miss a market-moving trade.

Unusual options activity is any large trade outside the market norms and typical trends. Individual traders making irregular trades are unlikely to move the markets. However, institutional investors and other whales in the markets may enter massive trades, indicating they know something others don’t or expect a specific outcome in the markets relatively soon.

Large spikes in volume for a specific asset or asset class can give insights into potential market moves or insider activity. And while a single small trader entering orders surrounding a particular asset may not be important, many traders buying calls or puts could add up to a significant signal.

Stories Of Unusual Options Activity

You don’t have to go too far into stock market history to find examples of unusual options activity. Here are a few interesting large options trades where traders like you could gain insights into insider and institutional investor strategies.

Michael Burry Shorts The Entire Stock Market

Michael Burry rose to fame as the trader who shorted the housing markets leading up to the 2008 industry unraveling. This earned his Scion Capital a massive return and vaulted him into an elite tier of famous investors who earned big betting against the crowd.

In late 2023, Burry made the news for entering a massive short trade against the entire stock market. Burry entered trades shorting an ETF that tracks the S&P 500 and an ETF that tracks the Nasdaq 100 index. He bought 2 million puts on each, easily enough to attract the attention of other investors and financial media.

He closed the positions later that year, which was another signal offering insights into Burry’s view of future market performance.

NVDA Insider Trading

Recent insider transactions at Nvidia have captured market attention, particularly sales by CFO Colette Kress and Director Mark Stevens, with notable sales executed at high prices. These transactions are part of a broader trend of insider selling within the company, influencing investor sentiment and potentially Nvidia’s market valuation.

This pattern of insider activity underscores the need for investors to monitor such transactions as part of their investment due diligence. Significant insider sales can serve as a barometer for a company’s prospects and may necessitate reevaluating investment strategies.

When insiders execute large trades, automated trading systems, including ones facing the options markets, typically respond as soon as the information is available. If you’re keeping close tabs, you may notice a shift in calls or puts around a specific stock, like Nvidia, and spot an opportunity to potentially profit.

Discovering Unusual Options Activity

Now that you understand what constitutes unusual trading activity and how you might interpret the data, you’re probably wondering where to find unusual options trades. Here’s a look at several platforms you can utilize for market data insights.

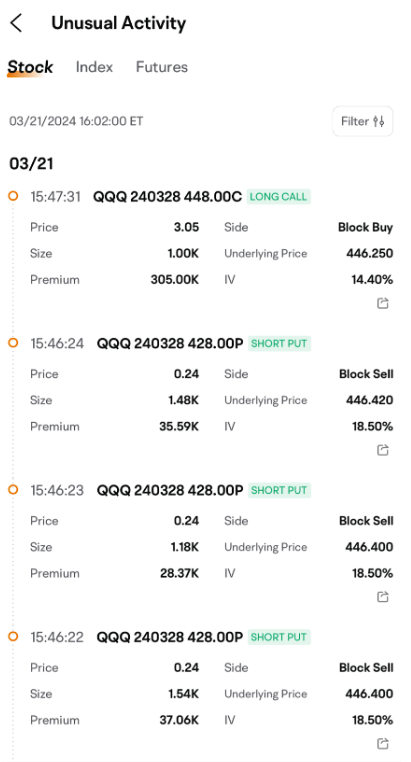

moomoo Options Unusual Activity

moomoo is a stock and options trading platform offering commission-free stock, ETF, and options trades. Users can unlock free access to level 2 market data and other analysis tools, helping to inform their investment strategy without paying extra.

The platform includes a section titled Options Unusual Activity. The Options Unusual Activity view highlights moments when there’s an unexpected, significant jump in trading a particular option. This surge often reflects the strategies or expectations of big-time players in the game, such as institutional investors.

Any app images provided are not current and any securities shown are for illustrative purposes only and is not a recommendation.

moomoo also offers a Capital Tracking chart to monitor net inflows and outflows. Combining the two may give you enough information to make an informed trading decision.

Any app images provided are not current and any securities shown are for illustrative purposes only and is not a recommendation.

Ready to get started? Check out moomoo here >>

Other Platforms For Unusual Options Activity Tracking

While moomoo’s tools are enough for many investors (and many are free to use on moomoo), you may want to utilize several tools to get a broad look at unusual options trading.

- Unusual Whales: A dedicated platform for options tracking, Unusual Whales offers robust tools to find unusual whale trades, but you’ll have to pay for access.

- ChatterQuant: The ChatterQuant platform monitors social media activity to find sentiments for or against a particular investment. It’s also a paid tool.

How To Leverage Unusual Options Activity

Making informed decisions in options trading requires a comprehensive strategy, leveraging insights from unusual options activity and other data sources. By interpreting these signals correctly, traders can develop strategies aligning with market movements and investment goals. With a good grip on risks and goals, you can implement trades to help reduce risk, speculate for potential gains, or adjust existing portfolios based on predicted market directions.

Successful trading is about more than recognizing patterns. Risk management is critical. Understanding and mitigating the risks associated with options trading are crucial in avoiding large-scale losses. Don’t just rely on single data points. Consider a range of indicators and market data to inform decisions. A well-thought-out risk management plan can better help traders from unexpected market shifts and minimize potential losses.

Finally, avoiding common pitfalls, such as following the herd without due diligence, is vital. Traders should always consider the bigger picture, looking beyond individual data points and avoiding decisions based purely on popular trends.

By maintaining a balanced view and conducting thorough research, investors can navigate volatile markets more effectively, make informed, strategic decisions, and be less prone to common missteps.

Having a tool like moomoo in your toolbox is a great way to help make savvier trading decisions.

Trade With Care For Options Success

Unusual options activity offers savvy investors a lens through which they can view potential market movements.

It’s not a magic crystal ball, but with the right approach and tools like moomoo, it can provide valuable insights. Stay informed, stay cautious, and use market knowledge to navigate the complex waters of the stock and options markets.

Get started with moomoo to earn a “Mag 7” fractional share bundle with a qualified deposit or 1.5% Cash Reward match ($300 max) on Transfers. Terms & Conditions apply >>

** Terms & Conditions apply. See www.moomoo.com/us/support/topic4_410 for details.

Options trading is risky and not appropriate for everyone. Read the Options Disclosure Document (j.us.moomoo.com/00xBBz) before trading. Options are complex and you may quickly lose the entire investment. Supporting docs for any claims will be furnished upon request.Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. Securities are offered through Moomoo Financial Inc., Member FINRA/SIPC. The creator is a paid influencer and is not affiliated with Moomoo Financial Inc. (MFI), Moomoo Technologies Inc. (MTI) or any other affiliate of them. Any comments or opinions provided by the influencer are their own and not necessarily the views of moomoo. Moomoo and its affiliates do not endorse any trading strategies that may be discussed or promoted herein and are not responsible for any services provided by the influencer. This advertisement is for informational and educational purposes only and is not investment advice or a recommendation to engage in any investment or financial strategy. Investing involves risk and the potential to lose principal.

Investment and financial decisions should always be made based on your specific financial needs, objectives, goals, time horizon and risk tolerance. Any illustrations, scenarios, or specific securities referenced herein are strictly for educational and illustrative purposes and is not a recommendation. Past performance does not guarantee future results.

[ad_2]

Victor osuhon

Wow

Zita boo

Nice