[ad_1]

Books & the Arts

/

August 26, 2024

The intractable puzzle of growth.

For more than a century, the key measure of a healthy economy has been its capacity to grow and yet if production and consumption continues to expand at their current rate we might risk the very health of the planet.

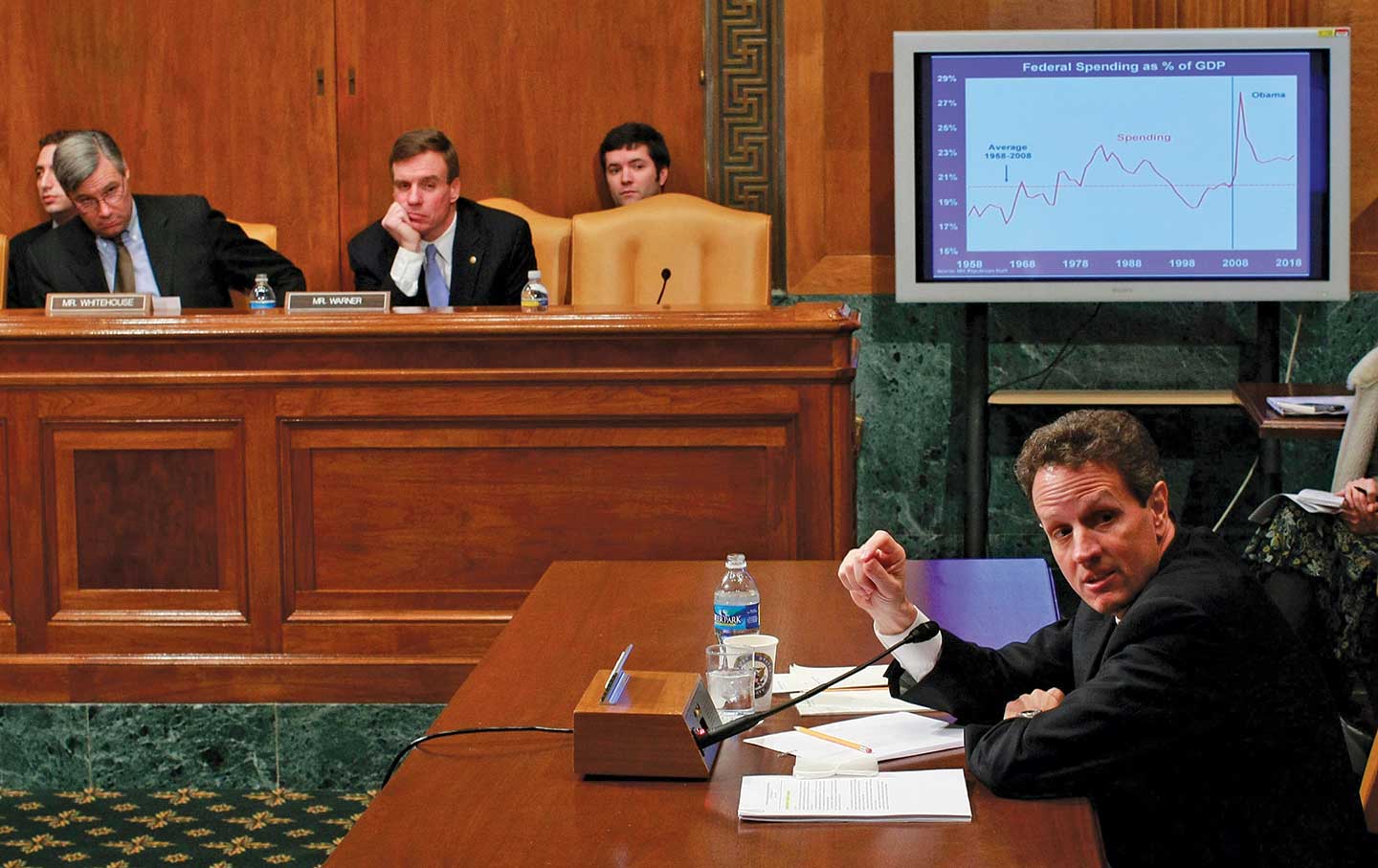

Then–US Treasury Secretary Timothy Geithner testifying before the Senate Budget Committee in 2009.

(Win McNamee / Getty )

Economic growth must continue. Economic growth must stop.

If an aporia is what occurs whenever we subscribe to two contradictory propositions at the same time, then this impossible dual imperative—growth must go on; growth cannot go on—surely counts as the great aporia of our time. Economic growth must go on for obvious reasons. If it doesn’t, businesses lose the incentive to invest, the ranks of the unemployed swell, government revenues stagnate, and social cohesion crumbles—and that’s for people fortunate enough to live in rich countries; poor countries remain condemned to poverty.

Books in review

-

Growth: A History and a Reckoning

by Daniel Susskind

Buy this book -

Slow Down: The Degrowth Manifesto

by Kohei Saitō; Brian Bergstrom, trans.

Buy this book

Unfortunately, it is no less obvious that economic growth can’t go on. If the production and consumption of more and more goods and services, for more and more people, requiring more and more energy, proceeds unchecked, environmental ruin is assured. Every year, an outfit called the Global Footprint Network calculates at what date on the calendar our planetary capitalist civilization will have used up all the natural resources that would be compatible with sustainability and entered into overshoot, “maintaining our ecological deficit by drawing down local resource stocks and accumulating carbon dioxide in the atmosphere.” In 2024, Earth Overshoot Day fell—like the secret anniversary of one’s own future death—on August 1, with five full months to go before the new year. No doubt the network’s exact calculus can be questioned; the idea that planetary capitalism is living beyond its means cannot.

Two new books allow us to stage, in a usefully stylized way, the confrontation between the advocates of continued economic growth, on the one hand, and the advocates of an opposite—and so far imaginary—phenomenon called degrowth, on the other. In Growth: A History and a Reckoning, the Oxford economist Daniel Susskind consults the balance sheet of a capitalist society dedicated to economic growth and concludes that in the 21st century, the singular ambition of growth may need to be modified but shouldn’t be abandoned. In Slow Down: The Degrowth Manifesto, by the Japanese Marxist scholar Kōhei Saitō, economic growth appears, by contrast, as a disastrous fetish to be immediately discarded by a world that can satisfy the joint criteria of sustainability and equality only by way of what Saitō calls “degrowth communism.”

The stakes of the debate could hardly be higher: They include your life and mine, and the lives of any children we are optimistic enough to conceive. But true appreciation of these 21st-century stakes can arrive only after a quick glance across long centuries that look very different from our own, in which growth either barely took place at all or—as in the long-ago 20th century—sounded to many ears like a byword for happiness, peace, and progress.

Growth as we know it—that is, year-over-year increases in the gross domestic product—acquired conceptual definition among economists only in the early decades of the 20th century. But this hardly means that standards of living didn’t improve or decline, or that overall levels of productive activity didn’t rise or fall, before the advent of motion pictures. As the nearly omniscient historian Fernand Braudel wrote in his History of Civilizations,

For a long time, people were humanity’s only implement or form of energy—the sole resource for building a civilization by sheer brawn or brain. In principle and in fact, therefore, increase in the population always helped the growth of civilization…. Just as regularly, however, when the population grows faster than the economy, what was once an advantage becomes a drawback…. The results in the past were famines, a fall in real earnings, popular uprisings, and grim periods of slump: until epidemics and starvation together brutally thinned out the too-serried ranks of human beings.

“Economic life,” Braudel went on, “never ceases to fluctuate, at intervals sometimes long and sometimes short.”

In a sense, economic growth and decline are as old as human life itself. Societies based on whatever mode of production—whether hunting and gathering or early agriculture or any other way of ensuring the means of human survival and flourishing—have always produced what professional economists in our own kind of society call goods and services. Since the beginning, people have grown or hunted or fashioned or constructed certain useful items, especially those that answer to Malthus’s four necessities: food, fiber (meaning clothing), fuel, and shelter. And in all periods of history, people have also performed certain useful activities—services, if you like—for one another that, unlike the production of goods, don’t directly transform the material world but do enable or enrich human life. We care for the young, ill, and ancient; we instruct, counsel, heal, entertain, and gratify one another; we transport, arrange, and dispose of various objects.

In principle, money—an alien or occasional device across most of human existence, rather than the ineluctable medium that it is for us—needn’t play any role in the production or distribution of goods and services. Regardless, then, of the prevailing mode of production, and independently of how much (if any) money changes hands, growth could be said to take place whenever a society is annually producing more and/or better goods (i.e., useful objects) and performing more and/or better services (i.e., useful activities) than it did the year before.

If, by contrast, no growth in either of these sectors occurs, something the early political economists from Adam Smith to John Stuart Mill called a “stationary state” would prevail. Or, in another generic scenario, the quantum of goods and services might in fact shrink. Today, we call such contraction a recession if it’s short-lived, or a depression if it persists. Capitalist thought doesn’t seem to possess any handy word for an economy that goes on shrinking indefinitely—although certain French radicals have in recent decades come to talk of décroissance, the English-language equivalent to which is degrowth.

Prior to the 20th century, no records were kept in any society either for sustained growth or expansion (“the progressive state,” as Adam Smith termed it); or for the stationary state of more or less no growth from year to year; or for prolonged contraction or degrowth. Posthumous statistical representations of such periods are by nature highly conjectural. This obscurity, however, hasn’t prevented economic historians from coming up with estimates of premodern growth, of which, they agree, there was generally very little: something like 0.05 percent annually before industrialization. Since the size of a country’s economy was largely a function of its population, China and India seem to have counted for a bit more than half of the world’s economic output in the year 1000 ad, “a proportion that remained unchanged for 600 years (and may be heading that way again),” as The Financial Times’ David Pilling observed in The Growth Delusion.

Just what happened about 400 years ago to permanently alter this global scene of immemorial stasis is a matter of debate. To be sure, a gradual commercialization of economic activity, especially in urban workshops, lay behind the rise of Europe—until the middle of the last millennium, an economic backwater soldered to the western side of Asia. So, too, did the spread of finance out of Italian city-states and the ever more efficient division of labor in manufacturing famously celebrated by Smith in The Wealth of Nations.

Subscribe to the Print Mag

CURRENT ISSUE

/

August 27, 2024

Subscribe

Even so, workshops and banking houses weren’t unique to Europe and therefore can’t account for the European economic takeoff on their own. For the Marxist economic historian Robert Brenner, the source of “self-sustaining growth” lay in the commodification of agriculture in 16th-century England. The historical innovation of producing most food for the market rather than for direct consumption unleashed, Brenner insisted, an ongoing revolution in labor productivity by increasing crop yields per acre and by separating people who had toiled in the fields from the land. Over several centuries, these displaced and propertyless masses became the industrial proletariat of England’s cities, willing to work themselves to the bone in factories in return for subsistence wages.

In The Great Divergence: China, Europe, and the Making of the Modern World Economy, the historian Kenneth Pomeranz offered a more ecologically suggestive formula for how to understand Britain’s pathbreaking departure in the early 1800s from the Malthusian rut carved by earlier societies. For Pomeranz, it was “coal and colonies” that permitted the UK and, later, other European powers to escape “the resource constraint” of any country that had to depend for its energy needs on whatever sunlight falls daily across its territory. In England, rich and—unlike in China—conveniently located coal deposits furnished a deforested land with the concentrated energy of bygone epochs and, along with a growing urban proletariat, constituted a fundamental ingredient of the industrial revolution. Meanwhile, overseas colonies—for a long time no better than an economic wash—eventually supplied a rainy island off the coast of Europe with a surplus of cheap foreign goods whose value exceeded the costs of colonization and shipping, especially once Britain’s commercial fleet was also powered by coal. (Pomeranz doesn’t spell out the environmental implications of his thesis for 21st-century global capitalism, but it’s clear that Britain’s 19th-century coal-and-colonies strategy can’t be applied on a planetary scale: The earth as a whole possesses no colonies, and the unbridled combustion of coal and other fossil fuels has pressed capitalist civilization to the brink of ruin.)

Cities and finance; the continuous commodification of agriculture and a permanent industrial revolution; the resort to fossil fuels and the extension of imperialism, along with a perpetual refinement of technology under way for at least 1,000 years—these are the factors whose relative priority and significance can be argued over endlessly in accounting for the advent of dramatic economic growth in 19th-century Europe. But no matter where one falls in this argument, what is beyond dispute is that the economic growth that was once, over approximately 300,000 years, a local and fleeting state of affairs has tended to become, since 1800 or so, an indispensable condition of societies everywhere. The sheer historical novelty of what we now so casually call “growth” no doubt does much to explain why it took until the 20th century for the phenomenon to be named as such, much less theorized, even in the European and North American heartlands of capitalism.

In the 19th and early 20th centuries, businessmen and economists typically spoke in terms of “the trade cycle” rather than any infinite bounty of growth, while social critics discussed material “improvement” and civilizational “progress.” In The Great Transformation, Karl Polanyi described how the middle classes of 19th-century England developed “an all but sacramental belief in the universal beneficence of profits”—but profitability figured in their minds more as an attribute of this or that individual enterprise than as a potential feature of the economy as a whole. Indeed, the idea of some all-enveloping national entity that you could reasonably call the economy—consisting of every last useful thing that anyone made or did or at least sold—is a distinctive creature of no earlier time than the 20th century. So, too, is how we have come to measure it: the gross domestic product (GDP), a notion that a crowd of recent books agree originated with the American economist Simon Kuznets.

Born into a Jewish family in Belarus in 1901, Kuznets received a PhD in economics from Columbia University in 1926 and, a year later, joined the fledgling National Bureau of Economic Research, where in the early days of the Franklin Roosevelt administration he was tasked with measuring the size of the American economy. As David Pilling puts it, Kuznet’s “notion was disarmingly simple: to squeeze all of human activity into a single number.” Concentrating on industrial sectors such as mining, manufacturing, and agriculture whose total output could be measured with relative certainty, Kuznets and his staff of eight canvassed owners and managers across the country about the scale of their operations in order to achieve an overall estimate of the size of economic activity. In January 1934, Kuznets presented to Congress a 261-page report simply called National Income, 1929–32. His pioneering methodology persists a century later: Even now, Pilling notes, “sizing up an economy remains primarily an extrapolation of survey data, not a summary of gathered facts.”

Unlike many later economists, Kuznets was sensitive to the conceptual liabilities lurking inside his method—and therefore suggested several qualifications to the idea of national income. On the one hand, heaping all economic activity together in the same bald sum would mean treating as undifferentiated “goods and services” undertakings that in fact either produced no benefit to society or actively disserved it. Kuznets thought that outlays on advertising, which merely promoted products rather than delivering them, should be excluded from national income statistics, and so should expenditures on armaments, meant as these were to destroy rather than improve human life. On the other hand, Kuznets also acknowledged that much production of genuinely beneficial goods and services took place outside the formal economy, especially in the form of housework. An estimate of the value of unwaged (and, needless to say, especially female) labor should be added to any measure of national accounts, just as the value of null or noxious activities should be deducted. These inaugural reservations, however, were typically ignored in the tabulation and mainstream discussion of national-accounts statistics once this mathematical novelty of the 1930s became, after the Second World War, a central feature of public life.

Before and during World War II, the idea of a national income that could be indexed by a single number seized the imagination of very few people who were not actively planning for or directing the war itself. It was above all politicians in the US and the UK who wanted an image of the total size of the economy in order to determine—as John Maynard Keynes, who was a wartime adviser to Winston Churchill, put it in a pamphlet from 1940—“how best to reconcile the demands of war and the claims of private consumption.” And the experience of a war economy burnished the concept of GDP in policy as well as budgetary terms, when unprecedented state involvement in financing and steering industry revealed “growth” as something the government could modulate as well as measure.

The best account of the postwar rise of GDP from statistical curio to popular fetish probably lies in Matthias Schmelzer’s The Hegemony of Growth, a 2016 history of the Organization for Economic Co-operation and Development and its postwar “making of the economic growth paradigm.” For Schmelzer, the relentless promotion of GDP growth as a social goal from the late 1940s onward served several purposes for the wealthy European and North American countries of the OECD. First, it replaced the familiar totem of “progress”—a fond slogan of European imperialism now discredited by colonialism and the Holocaust—with a social rationale that sounded objective and technocratic rather than racist and hypocritical. Second, the Western trumpeting of “growth” was meant to steal the thunder of the Soviet Union, whose breakneck economic development after the war the capitalist West could only envy. In five-year plans that explicitly mimicked Soviet ones, the OECD set out similarly ambitious goals for its own rate of economic expansion.

Growth became a central item of capitalist culture in another way too. Pitched battles between labor and capital over the distribution of society’s income had bedeviled capitalist countries since the 1800s. Now it seemed that such struggles could be muffled indefinitely: So long as there was always more growth, the fortunes of both workers and owners could improve forever. Indeed, escape from painful choices supplied much of the appeal of growth ideology. In More: The Politics of Economic Growth in Postwar America, the historian Robert Collins describes the advent of “growth liberalism” in the Democratic administrations of the 1960s. The Republican president, Dwight Eisenhower, spoke for an outdated understanding when he insisted, in his 1953 “Change for Peace” speech about the snowballing military-industrial complex, that “every gun that is made, every warship launched, every rocket fired signifies, in the final sense, a theft from those who hunger and are not fed, those who are cold and are not clothed.” For Lyndon Johnson, a decade or so later, no such trade-off—between warfare and welfare—was necessary. Galloping economic growth meant that the United States could afford both its Great Society programs at home and its campaign of mass murder in Vietnam.

In Matthias Schmelzer’s telling, the growth paradigm didn’t last long before receiving fundamental criticism on ecological and social grounds. By the 1970s, the ecological blind spot that “growth” inhabited already looked about as wide as the world, since national income statistics took no account of the relentless running down of what E.F. Schumacher had called “natural capital,” whether in the shape of oilfields or water tables. Socially speaking, meanwhile, the growth rates boasted of by politicians and economists flagrantly exhibited the very problem Kuznets had foreseen but not solved: They failed to distinguish between social wealth and social illth (in Ruskin’s old-fashioned word) so long as money values kept multiplying. A booming business in napalm and psychiatric meds counted as income just as much as that in books or bread, while the value of unwaged housework and uncommodified leisure was absent from official reckonings altogether.

One of the first economists to take a hammer to the idol of growth was Herman Daly, from the oil town of Houston. In his 1977 book Steady-State Economics, Daly outlined the basic defects of an economy hellbent on growth. To take GDP as the measure of all things was to be blind in two directions at once: It required neglecting both the “ultimate means” (finite natural resources) and the “ultimate ends” (the good life, in the Socratic rather than consumerist meaning of the term) of human existence. As Daly argued:

If there is no absolute scarcity to limit the possibility of growth (we can always substitute relatively abundant resources for relatively scarce ones), and no merely relative or trivial wants to limit the desirability of growth (wants in general are infinite and all wants are worthy of and capable of satisfaction…), then “growth forever and the more the better” is the logical consequence. It is also the reductio ad absurdum that exposes the growth orthodoxy as a rigorous exercise in wishful thinking.

For Daly, his fellow economists’ orthodoxies around growth betrayed a sort of intellectual imperialism. They supposed that the economy might contain all the world, when the opposite was the case: The formal economy amounted to a subset of earthly nature, which it could not mine, harvest, and pollute without sooner or later undermining its own ground. Human economies at some point had to cease to expand in relation to the bounded dimensions of nonhuman nature: “The first task would be to stabilize, get off the growth path. Later we could try to reduce quotas” on the use of natural resources “to a more sustainable level, if present levels proved too high.” Importantly, Daly specified his steady-state economy in terms of “biophysical throughput” rather than GDP or money values. He did so on the assumption that an ecological steady state would finally eventuate in an economic steady state that no longer expanded in GDP terms, either. After all, the increasingly efficient use of natural resources in the production of goods can be extended only so far, and continual refinement in the provision of services becomes at some point a question of preferences more than one of productivity. Recognizing that a stationary economy would return distributional questions to the fore, Daly went on to propose that it be governed not only by “depletion quotas” for natural resources but also by the institution of a (relatively low) maximum allowable personal income and a (relatively high) minimum income.

The most distinguished contemporary inheritor of Daly’s project is probably the English economist Kate Raworth, who in her 2017 book Doughnut Economics lays out in greater detail than he did the ideal features of a non-growing and circular, or doughnut-shaped, economy. Raworth’s somewhat silly pastry chef’s image contains a serious implication, namely that the daily bread of an economy beyond growth might be soft and sweet—not at all the stale crust of prior expansion that mainstream economics would lead us to expect.

Ad Policy

Recent years have witnessed particularly rapid growth in a cottage industry of what might be called growth-skeptical books. Some of these emphasize the essentially technical impediments to maintaining growth at the old 20th-century clip, such as lopsided demographics (too many retirees relative to young workers); pronounced inequality (too much saving on the part of rentiers relative to spending on the part of consumers); and high government debt (too much debt service relative to productive investment). Other recent titles have instead dwelled on the statistical and conceptual frailties of GDP as conventionally measured. And still other contributions to the discussion have stressed the inadequacy of growth from the standpoint of either international justice or individual happiness.

The most notable recent addition to the groaning bookshelf on growth and degrowth is surely Kōhei Saitō’s Slow Down, a disarmingly good-natured summons to “degrowth communism” as the political program that “will save the world.” Arriving at a moment of mounting ecological alarm, Slow Down became a surprise bestseller in Saitō’s native Japan and, in the United States, prompted The New York Times to run an admiring profile of the author.

To the Times, Saitō represented a more or less local Japanese phenomenon, having found a silver lining in the diminishing population and economic stasis of his own country. But Saitō could not be clearer that his vision is of a society beyond capitalism: Under capitalism, he argues, Japan’s feeble or nonexistent growth can represent only the calamity of overwork for some people and unemployment for others, not to mention environmental ruin for everyone as companies seek ever cheaper raw materials along with ever cheaper labor. Instead, “degrowth aims to bring about equality and sustainability. By contrast, the long-term stagnation of capitalism brings about nothing but inequality and want, which then leads to intensified competition among individuals.” In essence, Saitō’s degrowth communism would swap the environmentally reckless private industry of capitalism for a sort of thriving planetary commons in which the earth is humanity’s joint property.

With something of the herky-jerky earnestness of a PowerPoint presentation, Saitō makes this argument in Slow Down over a long series of very short sections. While “green growth” under capitalism is a flat impossibility, degrowth communism, he contends, is both possible and necessary, never mind that today most inhabitants of the wealthy world would reject both degrowth and communism on their own, let alone in tandem. In fact, according to Saitō, an incontestable warrant for his program lies in the late (and often unpublished) works of Karl Marx.

Saitō lobbies readers to discard the conventional image of Marx as a “productivist” prophet of the universal development of industry, such that the associated producers could one day wrest a worldwide—and pollution-spewing—factory from capitalist hands. Instead, Saitō’s Marx recognizes toward the end of his life that, for most of the world’s peoples, communism would entail (in Marx’s words) “a conscious and rational treatment of the land as permanent communal property, as the inalienable condition for the existence and reproduction of the chain of human generations,” without their having to first recapitulate the development of European capitalism and pass through the strait gates of industrialization. In this sense, we must “complete what [Marx] started…by fully theorizing what degrowth communism might look like” as a plenum of freedom, sustainability, and equality lying on the other side of capitalism.

The first part of Saitō’s argument, which rules out any sustainable capitalism, is naturally easier to accept than the more speculative and Marxological second part, for the simple reason that mere observation tends to ratify it every day. His contention that global capitalism “will place the world’s environment in danger” so long “as it aims for unlimited economic growth” may rely more on sheer assertion than sustained reasoning—but who can deny the claim?

Slow Down often has about it the genial vagueness of a graduation speech that means to inspire already sympathetic auditors rather than persuade the not-yet-convinced. That the book has been so popular suggests a large reservoir of preexisting anti-growth sentiment among the general public, and the very clumsiness and plainness of Saitō’s prose, at least in translation, can lend his writing a genuine power. It’s as though in advocating for degrowth communism, he is merely stating what should be apparent to just about anyone, as in fact may be the case. Here is something like the credo of Slow Down:

It’s a common misconception that the prime objective of degrowth is reducing the GDP. This leads to GDP becoming the only figure people look at in the conversation about degrowth…. In truth, the GDP is an extremely superficial indicator developed around a hundred years ago and one that has enormous statistical limitations. Given how much we’ve progressed from then, why are we still allowing ourselves to be manipulated by this crude measure?

As capitalism’s antithesis, degrowth emphasizes forms of prosperity and quality of life that aren’t necessarily reflected in the GDP. Degrowth is a transition from quantity (growth) to quality (flourishing). It’s a grand plan to transform the economy to a model that prioritizes the shrinking of the economic gap, the expansion of social security, and the maximization of free time, all while respecting planetary boundaries.

This passage exhibits both the allure and the frustration of Saitō’s manifesto. His picture of a post-capitalist society is at once attractive and cloudy. No doubt an adequate respect for planetary boundaries—of the nine that scientists have identified, six (to do with atmospheric carbon, freshwater availability, and the preservation of topsoil, among others) have already been transgressed—would curb capitalist productivity and therefore growth. Abandonment of capitalism appears in this light as an urgent commonsense imperative for everyone except capitalists. Its plausible replacement by degrowth communism is something else entirely.

The trouble with Saitō’s degrowth communism, in other words, stems not so much from its degrowth as from its Marxist or communist component. A first problem is narrowly philological: Despite Saitō’s contention that “what Marx achieved at the end of his life was a vision of degrowth communism,” he is able to demonstrate only that Marx—in anticipating communism as a development occurring (in Marx’s words) “after the productive forces have…increased with the all-around development of the individual, and all the springs of cooperative wealth flow more abundantly”—laid out a vision compatible with degrowth. He is unable to go further and show that Marx foresaw the need to deliberately restrict human claims on the natural world in a way either commensurate with our 21st-century predicament or necessarily embodied by a mature labor movement. Establishing that degrowth can coincide with Marxism is encouraging to Marxists like myself, but it falls far short of proving that the concept of degrowth communism somehow inheres in Marx’s own writing.

A second shortcoming of Saitō’s degrowth communism is more consequential. Above all, it lacks the sort of logical or “scientific” analysis of the revolutionary possibilities contained within capitalist society itself that was always meant to distinguish Marxism from more “utopian” or merely wishful varieties of socialism. For Marx and Engels, the simultaneous organization and impoverishment of the working class following from capitalist development would at length produce a social class capable of seizing the means of production from their owners. Saitō ventures a meeker speculation: “It seems entirely within the realm of possibility that enough people sincerely concerned with climate change and passionately committed to fighting it could gather to form a constituency of 3.5 percent”—the fraction of a given population, according to the Harvard political scientist Erica Chenoweth, supposedly necessary to “nonviolently bring about a major change to society.”

Popular

“swipe left below to view more authors”Swipe →

To say as much is to articulate a nice idea but not to identify any existing historical logic that might fuse sufficient numbers of people into a global movement powerful enough to overthrow not just this or that discriminatory law or oppressive national government (as in Chenoweth’s research) but something far more fundamental: namely, the growth-addled capitalist mode of production. The beneficiaries of the latter can be trusted to resist any real effort to expropriate them with quantities of propaganda and violence more familiar to the victims of 20th-century fascism than to social movements of recent decades. For this confrontation, we will need to be armed with more than Saitō’s goodwill.

Another recent entrant to the gathering controversy over growth is Daniel Susskind’s apologia for the concept, simply titled Growth. Unlike Saitō, working in a long tradition of radical anti-capitalism, Susskind is a mainstream liberal economist with positions at King’s College in London and Oxford University whose book bears an obliging blurb from Larry Summers, former secretary of the US Treasury.

In keeping with this conventional background, Susskind starts out by rehearsing the origins of GDP in the prewar ideas of Kuznets and Keynes. Any critic of growth would do the same. What distinguishes Susskind, across subsequent chapters, as an advocate of growth is his resolute praise of capitalist societies not by comparison to any future alternative—whether utopian or dystopian—but to a human past of chronic poverty. “Whether a person was a hunter-gatherer in the Stone Age or a laborer working in the eighteenth century,” he writes, “their economic fate was very similar: both are likely to have lived in poverty, engaged in a relentless struggle for subsistence.” This is to ignore the evidence that hunter-gatherers have on the whole enjoyed more leisure and often better diets than most inhabitants of stratified agricultural societies, but never mind: Susskind is right that “modern economic growth began” only in modern centuries, “when living standards in certain parts of the world started a dizzying climb.”

Susskind underlines the novelty of the phenomenon—“If the sum of human history were an hour long, then this reversal in fortune took place only in the last couple of seconds”—without pausing to wonder whether something so rare and new can reasonably be expected to go on indefinitely. (No need to dwell, meanwhile, on Susskind’s not-quite-grammatical, not-quite-idiomatic prose; unlike other departments of the economy, the literary skill of economists has shown zero growth or improvement since the invention of motor vehicles.)

Susskind vindicates growth for having afforded countless people “reduced levels of poverty, superior health, improved education,” as well as more abundant free time by comparison to their premodern ancestors. In this, his book has the breeziness of someone pushing at an open door. The left, whose critique has traveled side by side with capitalist growth like a shadow, never doubted, as Susskind says, that modern life often granted even poor people a measure of comfort and a kind of fulfillment denied to earlier generations. The old-fashioned socialist or communist proposition was simply that these modern satisfactions—and more—could be purchased without ceding human sovereignty and social equality to the runaway logic of capital. Today, an ecosocialist (or degrowth communist) addendum to this case points out that capitalist growth in the end promises not so much infinite growth as imminent collapse. In other words, the relevant comparisons to capitalism—a word that Susskind judges meaningless—lie not in the precapitalist past but in the dire future that capitalism appears to have made inevitable, and the alternative modernities it appears to have canceled.

In a chapter on “the extraordinary price of growth,” Susskind does make some concessions, allowing that the headlong pursuit of GDP has damaged the climate, exacerbated inequality, curbed the political influence of ordinary people, and induced perpetual instability in the job market. But what the young Marx believed about humanity—that it “sets itself only such problems as it is able to solve”—Susskind believes about growth. With the right mix of taxes and incentives, the excesses and oversights of the market can always be corrected.

In a chapter dedicated to degrowth, Susskind takes fright at the idea of such an economic program but displays scant acquaintance with its exponents. He worries that “degrowth means freezing GDP at its current level,” when most degrowth advocates plainly describe degrowth as a cap on resource use or biophysical throughput rather than a formal limit on GDP. He goes on to complain that degrowth would mean condemning “most of humankind…to ill health, to ignorance and superstition”—as if the world’s most expensive healthcare system, in the United States, didn’t produce inferior outcomes compared with countries where costs are half as much, and as if a good education required exceptional affluence rather than free time and books.

True, Susskind admits, the civilization of growth teeters on the lip on an ecological abyss. But a spot of mild intervention should be enough to course-correct: “Prices must be influenced (at times gently nudged, at other times forcefully cajoled) to close the gap between the market value they capture when left to their own devices and the social value they neglect.”

The obtuseness of such a perspective is not exactly theoretical. Susskind’s basic error is instead historical and political. Yes, the “potential” of the market also entails the potential of bridling and directing it, as you would a horse. The trouble, as anyone might easily learn from reading just about any newspaper or work of modern history you please, is that the beast that is the capitalist economy rides us, not we it. For this reason, the notional possibility of an array of controls on private capital sufficient to ensure environmental sustainability has never once proved a practical possibility—not across all the many decades that it’s been piously enunciated by mainstream economists who don’t wish to be the accomplices to planetary catastrophe that they are. Susskind’s naïveté might have been pardonable 40 or 50 years ago; in the third decade of the 21st century, it smacks of the ignorance and superstition he wrongly believes degrowth to impose. The heartwarming story about growth that he has to tell possesses little if anything in the way of new ideas (in spite of treating “ideas” as the ultimate source of theoretically infinite growth). His text is of interest mainly as a morbid symptom: Not long ago, growth enjoyed such a consensus as the regulating ambition of capitalist society that few mainstream writers saw the need to defend it.

Proponents of growth capitalism and degrowth communism rightly appear as antagonists, but they converge on a similar error. Both “growth” and “degrowth” refer to artificial and ultimately fictitious unities that consist, upon inspection, of elements of life too heterogeneous to be represented as the same substance of thing. For growth, the hallucinated substance was always GDP, in which no one could successfully distinguish between goods and services, on the one hand, and bads (if you will) and disservices, on the other. Degrowthers, for their part, mimic this mistake whenever they treat the nonhuman world as consisting of undifferentiated “nature”; in truth, wetlands and weather and wildlife can neither be reduced to one single substance nor substituted for one another. Saitō confesses as much when he admits, in an interview with New Left Review, that in fact we need to increase the production of some things and decrease that of others.

Still, it may be worth stating one’s allegiances clearly. The degrowthers are right: There needs to be a lot less physical stuff produced, especially in the way of fossil fuels, and, for anyone with the least sense of justice, this means rich countries consuming less and poor countries consuming more. Such an apparent threat of rich-country austerity meanwhile contains, in truth, the promise of abundance: fewer but more durable goods, less work and more leisure. (Already in the 1990s, the French-Austrian ecosocialist André Gorz wanted to “build the civilization of liberated time” in place of that of wage labor.) The fact that any such global rebalancing of consumption patterns can’t plausibly take place so long as the rich countries of the Global North dictate world history is one more reason that degrowth remains a dead letter under capitalism. It is not, however, the working classes of the Global North that must drastically curtail their lifestyles: The world’s richest 1 percent are responsible for as much carbon emissions as the poorest two-thirds of the global population. Much of the work of degrowth would be accomplished by the dispossession and destruction of the class represented by this sole percentile.

As for the idolaters of growth, their god has not only failed but, Cronus-like, has started devouring its children as if these were so many chicken wings. “Growth” fantasizes one kind of fake substance, and “degrowth” another; real intelligence demands attention to how the ingredients of this world are different, not the same. Even so, the advocates of degrowth (a more attractive English word might be Samuel Beckett’s “lessness”) can boast of a sounder moral and political intuition than can the usual apologists for growth: Less stuff, more life!

Such an argument may be obviated soon enough, either way, by the specter not of degrowth communism, but of prolonged capitalist contraction. Voters and politicians whistling past the graveyard being prepared for our children may have neglected to consult a recent article in Nature which holds that “the world economy is committed to an income reduction of 19% within the next 26 years independent of future emissions choices” (emphasis mine). Important factors in this bleak outlook include the declining agricultural yields and the massive and unpredictable damage to infrastructure attendant on climate collapse. In other words, even if carbon emissions are somehow reduced through the magic of the market, climate change can be expected to cause about $38 trillion in damages annually by the mid-century, enough to render overall economic growth infeasible. The choice facing the 21st century, then, is likely not between degrowth and growth. It is more likely between a form of capitalist contraction in which prosperity endures for a few but evaporates for the rest of us, and some kind of socialist or communist degrowth in which the well-being of everyone in general prevails over the wealth of anyone in particular. The precise politics of egalitarian degrowth are no more clear to me than they are to Saitō. But universal crisis will license strategies that theory alone could never discover.

Only in planetary disaster, at any rate, will we locate any promised land not yet underwater. In this matter, Theodor Adorno came closer to prophesying degrowth communism than Marx:

Perhaps the true society will grow tired of development and, out of freedom, leave possibilities unused, instead of storming under a confused compulsion toward the conquest of strange stars. A mankind which no longer knows want will begin to have an inkling of the delusory, futile nature of all the arrangements hitherto made in order to escape want, which used wealth to reproduce want on a larger scale.

Whatever chances this prospect might enjoy under ecosocialism or degrowth communism may be slight. The chances under capitalism, however, appear to be nil—an infinite difference registered in no statistics.

Can we count on you?

In the coming election, the fate of our democracy and fundamental civil rights are on the ballot. The conservative architects of Project 2025 are scheming to institutionalize Donald Trump’s authoritarian vision across all levels of government if he should win.

We’ve already seen events that fill us with both dread and cautious optimism—throughout it all, The Nation has been a bulwark against misinformation and an advocate for bold, principled perspectives. Our dedicated writers have sat down with Kamala Harris and Bernie Sanders for interviews, unpacked the shallow right-wing populist appeals of J.D. Vance, and debated the pathway for a Democratic victory in November.

Stories like these and the one you just read are vital at this critical juncture in our country’s history. Now more than ever, we need clear-eyed and deeply reported independent journalism to make sense of the headlines and sort fact from fiction. Donate today and join our 160-year legacy of speaking truth to power and uplifting the voices of grassroots advocates.

Throughout 2024 and what is likely the defining election of our lifetimes, we need your support to continue publishing the insightful journalism you rely on.

Thank you,

The Editors of The Nation

Benjamin Kunkel

Benjamin Kunkel is the author of Indecision (a novel), Utopia or Bust (essays), and Buzz (a play).

[ad_2]