The travel industry historically struggles with emerging

trends and technologies, and the topic of payments is no exception. Throughout the globe,

local payment methods provide competition and complexity for travel suppliers

and intermediaries according to Phocuswright’s latest report on the topic The State of Global Travel Payments.

These local solutions help promote more payment options and capabilities for

consumers, but are usually targeted to residents of that country or region.

Changes in payment are not happening in isolation. As

distribution and payment trends are interconnected, suppliers and

intermediaries use payment to drive greater loyalty and ease of use.

Different industry players approach the new payments landscape in their own

ways:

- Airlines’ focus on reshaping distribution through NDC

includes changing the payment landscape. - The hotel industry suffers from fragmented processes and

legacy technologies that prohibit rapid adoption of new payment methods. - Online travel agencies are leading the payment revolution by

embracing the merchant model and offering multiple FOPs to customers. - Traditional travel agents lack the ability to rapidly react

to payment changes in the market.

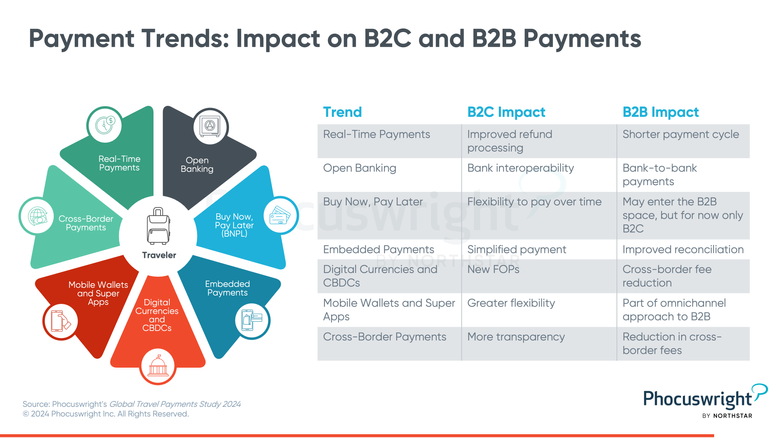

The travel industry must embrace emerging payment trends

despite the clear lag in adoption of these new payment methods. B2B survey

results illustrate an industry with payment pain points and a clear resistance

to emerging payment trends.

These two factors will eventually come to the surface, creating further

opportunities for innovative global payment solutions.

Some changes are being embraced as in the case with buy now,

pay later and virtual credit cards, which are becoming the de facto payment

choices for B2B travel transactions. Meanwhile, the higher fee credit

card-based infrastructure continues to dominate.

Key areas of focus for the future include:

- Cross-border payments continue to be a challenge for the

travel industry, with high transaction costs, lengthy processing times and

complex regulations. Companies offering a low-cost solution for cross-border

payments will be well positioned for success in the evolving global payments

marketplace. - Mobile payments are being adopted worldwide and the travel

industry views them as important for the future. They could evolve from a

standard FOP (e.g., a digital way to store credit cards) to become software

wallets that store value and represent tickets and reservations digitally. - Artificial intelligence has the potential to further transform the global

payments industry by enhancing payment orchestration, preventing fraud and

automating chargebacks.

The message is clear: The travel industry lags on payment

trends. What is needed today is a major push to educate industry players on

alternative payment methods and trends to lower costs, improve the customer

experience and reduce the settlement cycle.

Phocuswright is hopeful that this analysis can spark a dialogue among key

industry stakeholders to promote emerging trends and address some of the

inherent problems in the global travel industry payments landscape.

Phocuswright’s report The State of Global Travel Payments dives deep into a wide

range of payments topics, giving travel executives an unprecedented analysis of

the entire payment ecosystem in travel.

Learn more!

Phocuswright is the travel industry’s leading driver of

great decisions. Make confident, data-driven decisions that outpace your

competition by leveraging our in-depth insights and analysis.