ProPublica is a nonprofit newsroom that investigates abuses of power. Sign up for Dispatches, a newsletter that spotlights wrongdoing around the country, to receive our stories in your inbox every week.

[ad_1]

Last year, representatives of New Mexico’s oil industry met behind closed doors with the very groups with which they typically clash — state regulators and environmentalists — in search of an answer to the more than 70,000 wells sitting unplugged across the state. Many leak oil, brine and toxic or explosive gasses, and more than 1,700 have already been left to the public to clean up.

The situation is so dire that oil companies agreed to help try to find a solution.

After months of negotiations, the state regulators who ran the meetings emerged with a proposal that they hoped would appease everyone in the room. The bill would instruct drillers to set aside more money to plug their wells, authorize regulators to block risky sales to companies that would be unlikely to afford to clean up their wells and implement a buffer zone between wells and hospitals, schools, homes and other buildings.

The industry, unhappy with the state’s final language, turned against the bill it helped shape.

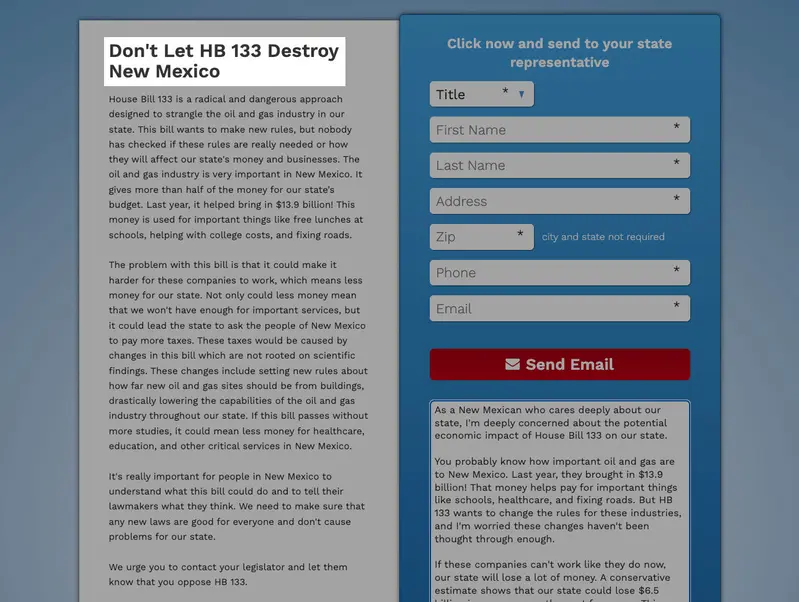

The influential New Mexico Oil and Gas Association told its supporters that HB 133 was “a radical and dangerous approach designed to strangle the oil and gas industry” and asked them to send their elected representatives a form letter opposing it. If passed, the trade group proclaimed, the bill would “Destroy New Mexico.” The Independent Petroleum Association of New Mexico, which represents small oil companies, called the bill “overzealous.”

Credit:

Screenshot and annotation by ProPublica

In the face of such opposition, Democrats removed key provisions. The New Mexico Oil and Gas Association eventually changed its position to neutral, but largely stripped of substance, the bill died on the floor of the House of Representatives.

“Industry killing the bills was the dynamic I saw,” said Adam Peltz, a senior attorney with the Environmental Defense Fund who helped write the New Mexico proposal, as well as similar bills in other oil-producing states.

New Mexico faces a multibillion-dollar shortfall between the money companies have set aside to plug wells and the actual cost of doing so, according to state research, a reality mirrored in many states.

Across the country, more than 2 million oil and gas wells sit unplugged, but the money held in cleanup funds, called bonds, is many tens of billions of dollars short of the projected costs, ProPublica and Capital & Main found. Now, a once-in-a-lifetime effort to shrink that shortfall is underway, spurred in large part by federal funding for well-plugging efforts.

As regulators and legislators seek to require that drillers set aside more money for the work, they have invited oil companies and trade groups to help write the regulations. This dynamic — politically expedient in states where the industry wields tremendous influence — has combined with secretive drafting processes and millions of dollars of industry lobbying to weaken or kill proposals in state after state.

In some, including Oklahoma and Utah, lawmakers propose bills only after oil trade groups approve the language. In many others, regulators and drillers work together through organizations such as the quasi-governmental Interstate Oil and Gas Compact Commission to design policy. But even when given a seat at the table, like in New Mexico, the industry has turned against reform efforts.

Holly Hopkins, a vice president of the American Petroleum Institute, the industry’s largest trade group, said in a statement, “We are continuing to work with policymakers to advance balanced regulations that enhance safety, sustainability and environmental stewardship and help ensure that American energy is produced responsibly from start to finish.”

Those working to reform a status quo that has left potentially millions of wells as orphans disagree. Sen. Jeff Merkley, an Oregon Democrat, is preparing to file a bill in Congress targeting oil companies’ use of bankruptcy to offload cleanup obligations on the public.

“The challenge in anything that involves fossil fuels, and particularly that addresses a profit strategy of fossil fuel companies, is you’re taking on the most powerful lobby in the United States of America,” he said.

“All Hell Broke Loose”

After a previous effort to update oil regulations failed in the New Mexico Legislature last year, the state convened a working group. Regulators, the industry and environmentalists spent months negotiating the details. Written with input from this broad coalition, and with the governor’s office and the Legislature in the hands of Democrats, it appeared the political stars had aligned.

But roadblocks quickly appeared. Lawmakers hadn’t been included in the negotiations, even though a sponsor would have to carry the bill through the session, which lasts only a few weeks. The talks were also closed to the public, and some environmental groups had been excluded because of ongoing litigation against the state.

As soon as Rep. Kristina Ortez, a Democrat, filed HB 133, “all hell broke loose,” she said, with infighting from the closed-door negotiations spilling into the Legislature.

“The oil and gas companies didn’t appreciate the language,” Ortez said. “They felt like they weren’t being listened to.”

Some environmentalists, meanwhile, felt that industry representatives had already watered down the bill too much during the negotiations and came out against it, she said.

HB 133 was picked apart further as it worked its way through the legislative process.

Credit:

New Mexico House of Representatives. Annotation by ProPublica.

With the New Mexico Oil and Gas Association now opposed, House committees submitted substitute measures to shift the industry’s position, gain votes and pass the bill. The amended versions eliminated a requirement that wells be a certain distance from schools and other buildings. Also gone was language to remove a cap on the monetary penalties regulators could assess against oil companies. And bonding requirements were watered down to the point that new, stricter rules would only apply to a handful of drillers.

By the time the rewritten legislation made it to the House floor, “I was so wildly unenthusiastic of the bill,” said Andrew Forkes-Gudmundson, who worked on it for environmental group Earthworks.

Missi Currier, the New Mexico Oil and Gas Association’s president and CEO, said that the group dropped its opposition after the bill was amended. But as the bill’s supporters whipped votes, they still encountered resistance from legislators who had been persuaded by small oil companies’ arguments that the new rules would push drillers out of business, Forkes-Gudmundson recalled.

Having hemorrhaged environmentalists’ support without gaining significant votes from moderates and conservatives, Democratic leadership never brought the bill up for a vote by the full House.

State-Sponsored Influence

Because the oil and gas industry is largely governed at the state level, states banded together in the 1930s with the approval of Congress, and more recently with federal funding, to share best practices for regulating oil. The resulting organization, the Interstate Oil and Gas Compact Commission, has evolved into a forum where, much as happened in New Mexico, the industry influences the ideas that regulators take back to their states and write into the rules governing oil companies.

This was on full display in October at the commission’s annual conference, hosted among Utah’s Wasatch Mountains, which were blanketed by autumnal reds and yellows. With Chevron, ExxonMobil and Oxy Petroleum among the conference’s largest sponsors, oil and gas regulators from across the country had gathered at the Chateaux Deer Valley, an upscale ski resort overlooking Park City’s renowned pistes.

As the conference began, regulators were clear-eyed that taxpayers could be saddled with the cost of plugging orphan wells.

“This year, I spent $29 million, and somehow that’s still not enough,” Jason Harmon, one of West Virginia’s head oil regulators, said about his state’s well-plugging efforts.

Catherine Dickert, New York’s top oil regulator, noted that wells in her state get passed to ever-smaller companies “until finally they get transferred to somebody who owns two wells that never, ever will be able to plug them.”

And cleanup funds are “woefully inadequate in Pennsylvania right now,” Kurt Klapkowski, the commonwealth’s lead oil regulator, told the attendees. “And we’ve gotten a lot of opposition about increasing that.”

But as the conference progressed, talk of bonding regulations gave way to discussions of repurposing old wells. Perhaps natural gas would still be needed to develop hydrogen fuel, an ExxonMobil representative discussed on a panel at the conference. Or wells could be used for storing captured carbon dioxide, an Oxy Petroleum representative said on another. State regulators returned home with these and other pitches from the oil industry on how to manage aging oil fields.

In addition to conferences, the organization pens pro-oil and gas resolutions that it has placed in state legislatures. In these resolutions, its members have called on the federal government to minimize regulations on climate-warming gasses, increase oil-related tax credits and shield certain royalty owners from cleanup costs. States including Wyoming, Utah and Oklahoma, among others, have passed resolutions pushed by the commission.

By the 1970s, the Department of Justice was arguing that the Interstate Oil and Gas Compact Commission had largely become a lobbying organization. Critics today say the commission is hampering reform.

“They’re this unique mechanism for corporate capture,” said Jesse Coleman, a senior researcher with public interest watchdog organization Documented who has tracked the commission for years. “They get to act as this impartial source of information, when in reality, they’re on the industry side.”

While about 60% of the people involved with the group were government officials, a quarter worked in the oil and gas industry, according to a 2021 membership survey Documented obtained via a public records request. The Environmental Defense Fund is typically the only green group in the room.

The survey also found that people involved with the group saw its role as promoting “diverse viewpoints on climate related issues” and “fighting back against measures that seek to ‘keep it in the ground’” — the “it” referring to climate-warming fossil fuels.

Credit:

Courtesy of Jesse Coleman/Documented

As the U.S. Department of the Interior doles out $4.7 billion to plug orphan wells from the Infrastructure Investment and Jobs Act, the commission and its members have helped write guidelines governing the spending, most of which is going to states, documents obtained via public records requests revealed. In many cases, the commission’s suggestions were highly technical and provided assistance to a federal department trying to navigate various states’ unique laws.

But at other times, the commission and its members asked the Interior Department to tear up requirements that states prioritize plugging wells that are emitting methane, a potent greenhouse gas, and pay the regional prevailing wage to workers hired to do the plugging.

In an email responding to questions, Lori Wrotenbery, the commission’s executive director, said the group’s pushback was justified because the Interior Department had exceeded its authority in telling states how to spend the money.

For Coleman, resistance from the commission comes as no surprise.

“The regulations and the resolutions that they promote have allowed a greater degree of pollution,” he said, “and have allowed greater leniency on the oil and gas industry.”

Reform Efforts Failing to Launch

Despite industry pressure, some states have begun addressing the orphan well epidemic. California passed a law in October that could significantly increase oil companies’ bonds. A few weeks later, Louisiana strengthened rules pushing companies to more quickly plug wells that aren’t pumping.

But New Mexico’s story is more typical. There and around the country, reform efforts have foundered.

Oklahoma, for example, faces an estimated shortfall of more than $7 billion between cleanup costs and bonds, according to state data analyzed by ProPublica and Capital & Main. Still, a group of Republican legislators has tried and failed for several years to increase the state’s bonding levels.

This legislative session, Rep. Brad Boles, a Republican, ran a bill to increase the highest level of required bonds from $25,000 to $150,000. Boles told a House committee that he had worked with two oil trade groups on the bill, describing it as “language that helps move the needle but also is not seen as anti-industry.”

His proposal unanimously passed the House of Representatives and a Senate committee. Even so, it died without a vote in the Senate. (Boles declined to “point fingers at any particular person or group” for its failure but said he would try again next session.)

Meanwhile in West Virginia, which has a projected bonding shortfall of more than $15 billion and some of the nation’s weakest bonding laws, a bill to strengthen regulations never made it onto a committee agenda. This is the sixth straight year that such legislation has failed, Mountain State Spotlight reported.

The bill’s lead sponsors did not respond to requests for comment.

“The industry has a pretty solid lock on the Legislature,” said David McMahon, a West Virginia attorney who drafted this year’s bill.

In New Mexico, Ortez, the legislator who ran HB 133, said she was “dismayed” by how the bill fell apart, even though it was “maybe too fair” to oil and gas companies. But she hasn’t given up, pledging to continue pitching the industry on reform and finding language that can secure the necessary votes in advance of next year’s legislative session.

“I feel so strongly about this moving forward,” she said. “We need to make it happen.”

Nick Bowlin of Capital & Main contributed reporting.

[ad_2]