[ad_1]

Well folks, as anticipated, bidding wars are back with a vengeance, at least here in San Francisco.

If I were a real estate agent, I would never encourage my clients to engage in a bidding war. Winning such a war often leads to what’s known as the “winner’s curse.” This term signifies paying a price that exceeds what anyone else in the bidding war was willing to pay, putting your finances at greater risk if the real estate market takes a downturn.

Personally, I avoid bidding wars because I know my emotions can cloud my judgment. It’s akin to my approach to poker—I refrain from heavy drinking to keep a clear head for rational decision-making. And for those looking for love, take off those beer goggles!

This post delves into the reasons why people enter property bidding wars. I aim to comprehend why potential property owners disregard my advice of searching for homes during the slow winter months. It baffles me why more potential owners wouldn’t opt to underbid on a poorly marketed, mispriced, or stagnant listing rather than one that’s presented perfectly.

I seek to understand because I may have a blind spot that requires fixing. Let me share some bidding war examples followed by feedback from a real estate agent and three homebuyers on why they engaged in a bidding war.

Why I Currently Care So Much About The Housing Market

I’ve been closely following the housing market since purchasing my new home on the west side of San Francisco in the fall of 2023. For months, I experienced both a liquidity crunch as well as doubt on whether I had made the right decision to slash my passive income for a nicer house.

As the stock market marched higher after I sold stocks to buy the house, I felt conflicted. On the one hand, I was missing out on stock market gains. On the other hand, my family was enjoying a nicer place to live. The home purchase could turn out to be the biggest or worst financial mistake of my life.

More than seven months later, I’m relieved to say that buying this house has turned out fine so far. The home withstood heavy rainstorms during the winter without leaks or major problems, which is my most concerning house maintenance issue. Meanwhile, housing prices have rebounded in spring 2024 thanks to pent-up demand, a rise in tech stocks, and a continued dearth of inventory.

Here are some examples of homes that sold way above asking. If one of these homes happens to be yours and you want it taken down, feel free to leave a comment or shoot me an e-mail. I’ll do so immediately to respect your privacy.

Examples Of Property Bidding Wars In San Francisco

1615 Funston Avenue (Inner Sunset/Golden Gate Heights border)) – 2 beds, 1.5 baths, 1,230 sqft, asking $1,495,000, sold for $1,675,000, or $180,000 over asking (12%). Although a small house, it is nicely remodeled inside and out. Paying under $2 million for a remodeled single-family home in San Francisco is what a lot of families want.

220 Magellan Avenue (Forest Hill) – 3 bed, 2.5 bath, 2,455 sqft, asking $2,795,000, sold for $3,125,000, or $330,000 over asking (11.8%). Handsome home on a tree-lined block in the best neighborhood on the west side of San Francisco. The price point between $2 – $3.5 million is common for dual income, mid-career households with children.

68 Madrone Avenue (West Portal) – 3 bed, 3.5 bath, 2,836 sqft, asking $2,495,000, sold for $3,125,000, or $630,000 over asking (25.25%). Although it sold for 25.25% over asking, the price seems reasonable for its size and location.

80 San Pablo Avenue (St. Francis Wood ) – 3 beds, 2.5 baths, 2,190 sqft, asking $2,295,000, sold for $2,500,000, or $205,000 over asking (9%). A quaint house at a reasonable price on a relatively quiet street. St. Francis Wood is one of my favorite neighborhoods with only single-family houses. The only negative is that the neighborhood is bordered by some very busy streets as well as a high-traffic intersecting street.

Several Truly Massive Overbids

120 Lenox Way (West Portal)- 4 beds, 2.5 baths, 2,221 sqft, asking $1.795 million, sold for $2.56 million, or $765,000 over asking (42.6%). The house received 15 offers and is across from a playground and school. Depending on the individual, this can be a good or bad thing. The house is only a block away from the MUNI station, and two blocks away from shops and restaurants.

3782 21st Street (Dolores Heights) – 2 beds, 2.5 baths, 1,844 sqft, asking $2,395,000, sold for $3,225,000, or $830,000 over asking (34.6%). This was truly an amazing sale given how small the house is, as well as the lot size of only 1,410 sqft. Standard lot sizes in San Francisco are 2,500 sqft. It’s a charming house for sure. But wow.

150 Santa Paula Avenue (St. Francis Wood) – 5 beds, 3 baths, 3,585 sqft, asking $4,795,000, sold for $5,705,000, or $910,000 over asking (19%). The house sits on a large 8,659 sqft lot, which is extremely rare in San Francisco. It was on the market for only a week and received a preemptive offer, which I’m guessing was all cash. For a family with children, this enclosed yard is special.

The sales price of $5,705,000 blows past Redfin’s estimate, which is consistent with most of these recent sales.

240 Santa Paula Avenue (St. Francis Wood) – 3 beds, 2.5 baths, 2,298 sqft, asking $2,695,000, sold for $3,325,000, or $630,000 over asking (23.4%). A unique house that reminds me of homes in Hansel and Gretel. I’m not sure why someone had to pay so much over asking given its regular size. It’s also bordering the playground/park, which can be both good and bad, depending on who you ask.

Some Impressive Sales Below Asking

If you go up the price curve, you can generally get better deals. Bidding wars are more rare at higher price points simply because fewer people can afford these homes.

565 Ortega Street (Golden Gate Heights) – 5 beds, 3.5 baths, amazing remodel asking $5,950,000, sold for $5,550,000. This was one of the coolest houses I’ve ever seen due to the design. It felt like a prized work of art with a separate unit and panoramic ocean views. I love this house.

The listing agent didn’t list the estimated sqft likely because it would put the house at an all-time high price/sqft based on the asking price. If you can buy a single-family home with a water view, I think you’re going to outperform the market for a long time. Golden Gate Heights is one of my favorite areas to buy single-family homes in San Francisco.

This house was a gut remodel that took what seems like over five years. My main concern is fixing custom items and sourcing custom materials when something inevitability breaks.

The previous owner purchased the house for $2,650,00 in July 2016. Notice how the sales price of $5,550,000 completely obliterates the Redfin estimate due to the remodel. Now Redfin’s algorithm needs to recalculate other homes in the area.

3846 25th St. (Noe Valley) – 4 beds, 3.5 baths, newly remodeled asking $6,495,000, sold for $6,375,000. Impressive high end remodel and landscaping. These type of remodeled homes used to sell for closer to $4.5-$5 million.

3898 Washington Street (Presidio Heights) – 7 beds, 6 baths, 8,765 sqft, asking $14,950,000, sold for $14,700,000. Handsome home on a corner lot that gets a lot of light. Personally, I’d rather not live on the corner due to more traffic exposure. Presidio Heights is one of the most expensive neighborhoods in all of San Francisco.

Once more, you can observe how the sales price significantly exceeds the Redfin estimate. Redfin will require some time to adjust its pricing algorithm to accurately reflect the rising prices in the neighborhood.

The inaccuracy in housing estimates provided by Zillow and Redfin presents an opportunity for both sellers and buyers. If a buyer can discern that online housing valuation estimates tend to lag behind in a bullish market, they might endeavor to convince a less astute seller to agree to a lower market price.

Feedback From Homebuyers And Real Estate Agents Who Got Into Property Bidding Wars

To understand why people get into property bidding wars, I decided to survey my Twitter followers and newsletter readers. Here is some of their feedback:

Anonymous feedback on getting into a bidding war in 2022:

Two years ago, we bought a small condo in a college town for my daughter to live in while she attends school. I grew up near that town, so I am familiar with and I love the area.

Yes, I perceived it as a bit risky to compete in a bidding war for the condo. However, we heard horror stories about so many college students in that area who struggled to locate suitable housing. We did not want to search and compete for a place every school year.

Also, my daughter is very private and picky and hasn’t done well with roommates. I intend to keep the property for the long term, so I wasn’t as worried about the exact purchase price. We needed the property, since I would have had to pay rent at another place if I didn’t buy it.

There had been a stagnant listing available that winter. However, it needed more work done to it and had original windows and appliances. Also, the stagnant listing did not have a southern orientation and peaceful view.

In the recent past, we had purchased a house with a northern exposure in our city where we reside full time. We have been dissatisfied with how cold and dark our house is during winter months without running the heater a lot. Running the heater doesn’t provide the pleasant warmth of sunlight.

I had decided that I would not purchase a place for family use without a southern exposure. I guess I was willing to pay 8% more to have southern sunlight and not be looking into a neighbor’s place.

In the past two years, I have never regretted entering into and prevailing in a bidding war for my daughter’s peaceful, sunny condo. Also, I knew that if circumstances change, I can easily rent the condo out to college students for a lucrative amount.

Keeping property for the long term requires a big commitment of time and ongoing expenditures. If you have an emotional connection to the property, it helps you weather the downside of long term property ownership like a nightmare tenant situation or a major plumbing issue.

Thank you for your terrific articles!

Jaime Meraz, Realtor based in Phoenix, Arizona

Marcus, 40, buyer in San Francisco, California

Before buying our house, my wife and I resided in a one-bedroom, one-bathroom apartment. But with a baby on the way, we needed more space. Having worked as a software engineer at Tesla for five years, I was fortunate to walk away with approximately $2 million in equity after taxes.

Considering my current salary of $200,000, along with stock options, and my wife’s salary of $150,000, we can comfortably put down $500,000 for a $2.5 million house. This means we’d be looking at a monthly mortgage payment of $13,700 at a 7.3% mortgage rate with over $1.5 million in cash and liquid investments left over.

We anticipate a window to refinance to a lower mortgage rate within the next five years. By then, we expect our income to have increased as well.

Janet, 38, buyer in Northern Virginia suburb

During the winter, the housing inventory wasn’t particularly appealing, and we were determined to only make a purchase if we stumbled upon something truly exceptional. Then, in March, our dream home appeared—a spacious property with a stunning view. What made it even more appealing was that the sellers had recently renovated the house, sparing us from potential renovation headaches we’d heard about.

With our children aged 8 and 10, and plans to reside in the area for at least a decade, we felt confident in our decision. The schools are excellent, and there are reputable public universities nearby. Even if we may have slightly overspent, our long-term commitment to the house reassured us. Who knows, we might even make it our forever home.

With a combined income of about $280,000, we purchased a $1.2 million home that was listed for $1.1 million in Fairfax County. Admittedly, we deviated from your 30/30/3 home buying rule, but we managed to put down $350,000. Our mortgage is a 6.5%, 30-year fixed rate, amounting to $6,000 per month. However, with a gross monthly income of $23,333, we feel it is affordable.

So far we love the house and have no regrets.

Thoughts On the Property Bidding War Feedback

There are two key takeaways from the homeowners who shared why they engaged in a property bidding war.

1) They can comfortably afford the prices they pay.

There seems to be a misconception that only desperate or financially inexperienced buyers participate in bidding wars, stretching themselves thin. However, it appears that well-educated buyers with strong financial profiles are the ones willing to overbid on homes.

Reflecting on my own experience, I realize I lack the confidence to overbid due to a past setback in 2007 when I ended up paying too much for a condo in Palisades, Lake Tahoe. That experience left a lasting impact, shaping my future decision-making.

2) They all have children.

Every buyer mentioned having children, ranging from those yet to be born to college students. The desire to provide a comfortable home for one’s children is a strong motivator. Indeed, I believe the best time to own the nicest house you can afford is when you have the most family members under one roof.

Concerned about the future cost of housing when my children are ready to buy homes in 20-25 years, I’ve chosen to hedge my bets by investing in at least one rental property per family member. While my primary real estate goal is to generate semi-passive income for retirement, I also aim to provide my children with affordable housing options in the future.

3) They all plan to live in their new houses for a long time.

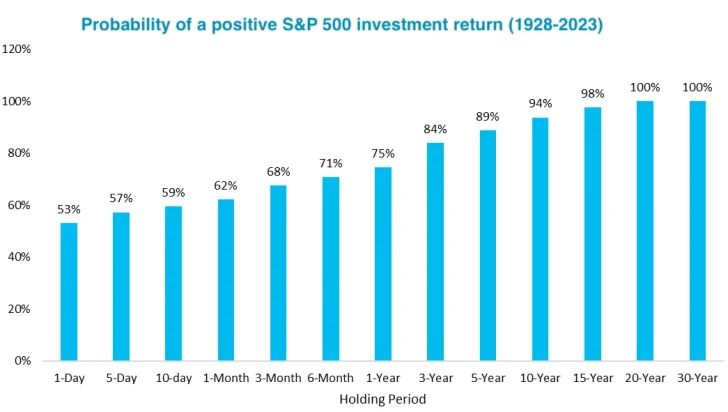

The longer a property bidding war winner lives in their home, the greater their chances of building equity. It’s the same idea with owning stocks.

Currently, the median homeownership duration is about 12 years. If bidding war winners can hold for at least the median duration, they will likely still make a profit when they sell.

Please Still Be Careful About Overbidding On a Property

After going through this exercise, I still hold reservations about engaging in property bidding wars. At heart, I’m a bargain hunter, always on the lookout for value due to mispricing, bad timing, or ineffective marketing. Because real estate transactions heavily rely on people, I believe savvy buyers can exploit inefficiencies to secure a better deal.

I’ve documented various strategies I’ve employed to negotiate lower purchase prices, such as delaying escrow, writing heartfelt real estate love letters, making offers with no financing contingencies, and pursuing dual agency routes. All these tactics have proven effective in my 21+ years of real estate investing. Hence, I find it difficult to deviate from my established approach.

However, for those who have emerged victorious in property bidding wars, there’s reassurance in the relative efficiency of the real estate market.

Simply underbidding on a property doesn’t automatically translate to a better deal; perhaps the property was initially priced too high. Conversely, paying 20% over asking doesn’t necessarily equate to overpayment; it may indicate the property was initially underpriced.

There’s Always Another Nice Home Waiting To Be Purchased

In the long run, the market will determine the fair price of a home. My concern is that heightened emotions often cloud the judgment of prospective homebuyers. Many envision an idyllic life in their future home, leading them to believe it’s worth paying more for perfection.

The reality is, if you miss out on one home, there will always be another equally suitable option for your family. It’s essential to acknowledge this and exercise patience.

Establish a definitive maximum price you’re willing and able to pay, and stick to it, no matter what. Following this advice will minimize the risk of buyer’s remorse and safeguard your financial well-being in the process.

Best of luck out there!

Reader questions

Why do you think buyers are willing to engage in property bidding wars, despite the risk of paying too much? If you’ve ever won a property bidding war, please share your experience and reasoning to help us understand why. Why not just wait until the 4th quarter to buy given there’s less competition and more wiggle room for price adjustments?

Invest In Real Estate More Strategically

Instead of getting into a bidding war, consider investing in passive real estate investments across the country for diversification, passive income, and potentially better returns.

Consider Fundrise, a leading private real estate investment firm with over $3.3 billion in assets under management. Fundrise primarily focuses on residential and industrial real estate in the Sunbelt region, where valuations tend to be lower and yields tend to be higher.

Personally, I’ve allocated $954,000 to private real estate funds, primarily targeting properties in the heartland. With remote work becoming more common, it’s reasonable to expect that Americans will increasingly gravitate toward lower-cost areas of the country.

Fundrise is a sponsor of Financial Samurai and Financial Samurai is an investor in Fundrise.

[ad_2]

Victor osuhon

Nice