[ad_1]

By Jimisayo Opanuga

21 April 2024 |

6:00 am

Odiri Oginni: The Woman Who Makes Money Move In the world of finance, few individuals have made a lasting impact like Odiri Oginni, the CEO of United Capital Asset Management Limited (UCAML), a subsidiary of United Capital Plc. Odiri, who grew up as a shy young girl with a passion for numbers that rivalled her…

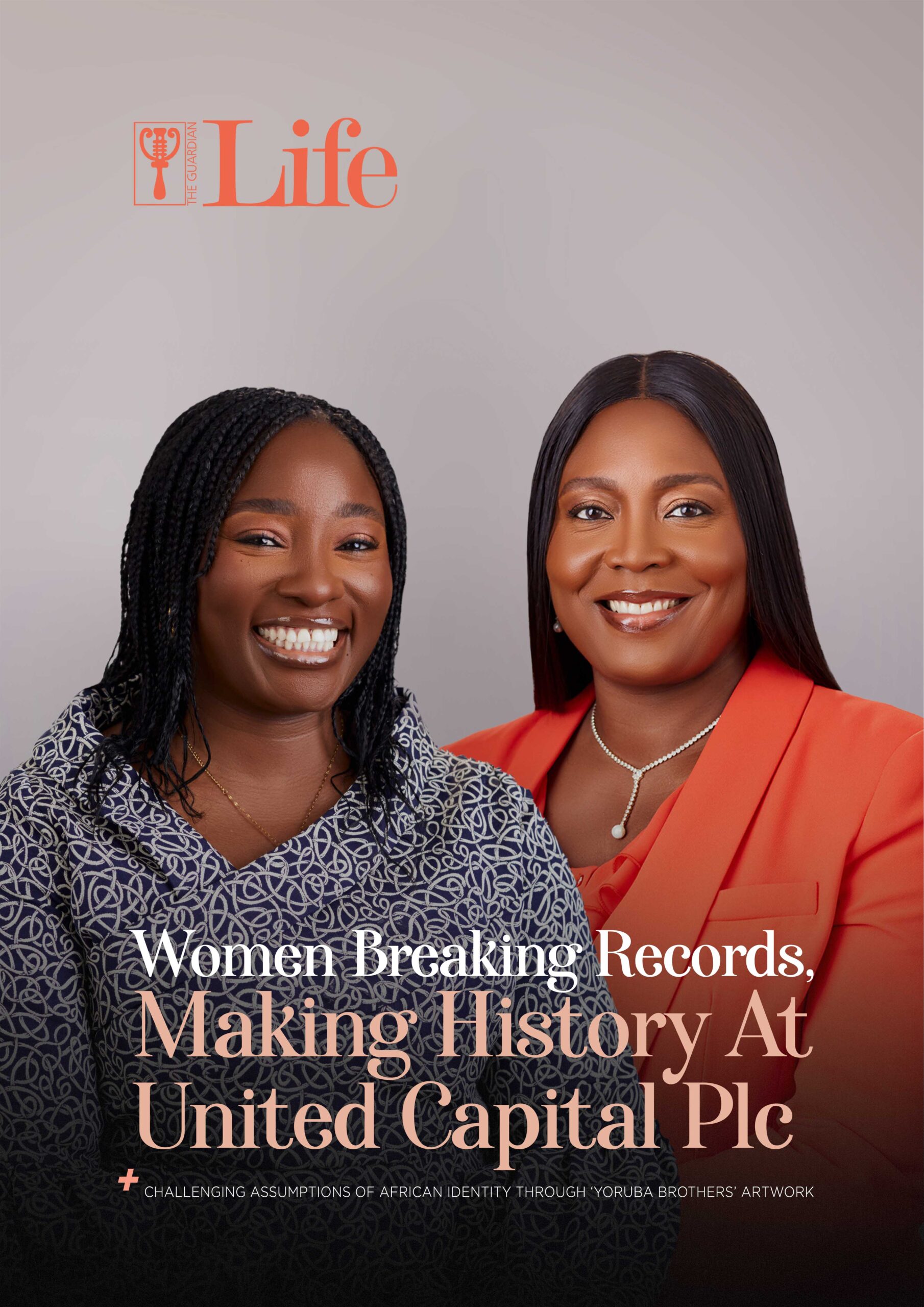

Odiri Oginni: The Woman Who Makes Money Move

In the world of finance, few individuals have made a lasting impact like Odiri Oginni, the CEO of United Capital Asset Management Limited (UCAML), a subsidiary of United Capital Plc.

Odiri, who grew up as a shy young girl with a passion for numbers that rivalled her love for life itself, actively sought opportunities to challenge herself.

Odiri, who chased excellence with every fibre of her being, earned top honours in accounting from Babcock University, cemented her status in the world of finance, initially as an auditor at Deloitte, and later ascended to the role of Chief Finance Officer and MD/CEO, United Capital Asset Management. With over 17 years, she has been instrumental in shaping business strategy and corporate performance in the financial services industry.

Odiri, who broke through glass ceilings and consistently exceeded expectations, is a CFA Charter holder and achieved the status of Fellow of the Institute of Chartered Accountants.

Odiri, who took on the role of CEO at United Capital Asset Management Limited in 2019, oversees assets under management of over N800 billion.

Odiri, who saw the need to address the gender gap in financial literacy, spearheaded the #ThisGirlInvests campaign to empower and inspire women to take control of their financial futures through investment in the capital market.

Despite wearing all these hats in the boardroom, Odiri still finds joy in her role as a devoted wife and mother of three beautiful children. She navigates her demanding career with the same skill and dedication she brings to caring for her family.

To the ordinary person, this ought to be a victory lap, a chance to bask in the culmination of her efforts. Rather, Odiri realizes that this is not a bus stop but that her journey has just begun, as she burns with a relentless fire to redefine leadership in her industry and break down the barriers that constrain women.

“My career journey has been characterised by a blend of passion, perseverance, continuous learning, and professional growth,” says Odiri in an exclusive interview with Guardian Life “My biggest influences have been the invaluable guidance of mentors and sponsors who championed my growth and advocated for opportunities on my behalf.”

The Impact

UCAML has seen incredible growth under Odiri’s leadership, with assets under management growing from N7 billion to over N800 billion. The company’s mutual funds were underperforming when she took over as CEO in January 2019; they had only N7 billion in assets under management and were ranked 10th in the sector. Today, the company is ranked 2nd in the same category.

Odiri saw an opportunity to add value, strengthen the company’s position as a market leader, and increase its visibility. “Under my leadership, we embarked on a transformative journey focused on three key strategies: having a clear vision, a client-focused approach and building a strong team,” Odiri shares. “Through these strategic initiatives and dedicated efforts, we successfully grew the assets under management of our mutual funds from N7 billion to over N800 billion.”

Today, Odiri has been able to position the firm as the second-largest mutual fund manager in Nigeria and, notably, the largest fixed-income fund manager. UCAML now manages a total asset of nearly N1 trillion across multiple asset classes and investment strategies.

“The most exciting aspect of my role as CEO is witnessing the impact of our work on our client’s financial success and the growth of our organisation. Seeing our investment strategies generate positive returns for our clients and contribute to their long-term financial goals is incredibly rewarding. Additionally, leading a team of talented professionals and witnessing their growth and development brings me great joy and fulfilment.”

Odiri attributes her leadership approach to a blend of visionary guidance, teamwork, and empowerment. “I articulate a clear vision and strategic direction for the company and rally the team members around to achieve it. I also prioritise empowering my team by entrusting them with responsibilities and encouraging them to be innovative.”

She continued, “Also, open and transparent communication is fundamental to me, ensuring that everyone’s perspectives are heard and valued. I believe that true leadership is defined by service, and I strive to exemplify this principle as I lead the team. In essence, my leadership style fosters a supportive, collaborative, and inclusive environment where team members are empowered to excel, innovate, and achieve success together.”

Approach To Success

While Oginni finds immense satisfaction in her role as CEO, none of this came easily; she opened up to Guardian Life about the challenges that come with the job. “One of the biggest challenges I’ve faced is navigating through periods of economic uncertainty and market volatility. In such times, maintaining client confidence and managing their expectations becomes paramount. “

To address this issue, Oginni said she prioritises communication and transparency, providing regular updates and market insights to ensure clients are well-informed and reassured about their investment decisions. But the issues extend beyond the caprices of the market.

“Another significant challenge, I would say, has been staying ahead of ever-changing industry trends and technological advancements. The financial services industry is constantly evolving, with new regulations, technologies, and competitors emerging regularly,

“To navigate this challenge, I foster a culture of continuous learning within our organisation. We invest in training and development and encourage team members to stay abreast of industry trends through training and professional development opportunities.”

Though the CEO role is not for the faint of heart, Oginni believes that with resilience, innovation, and teamwork, she can conquer any obstacle that comes her way. In the end, the allure of overcoming these hurdles only serves as an incentive for her to work even harder, continually striving for excellence in leading the company forward.

When it comes to career success, the question on everyone’s mind is: What’s the cost? Has Oginni ‘s rise to the top come at the expense of her personal life? She shares her thoughts on the matter

“Achieving career success often requires dedication, hard work, and sacrifice, but it doesn’t necessarily have to come at the expense of one’s personal life,” she begins. “While there may be times when balancing professional responsibilities and personal commitments feels challenging, I believe that maintaining a healthy work-life balance is essential for overall well-being and sustained success.”

But true success, for Oginni, encompasses not only career accomplishments but also personal fulfilment, happiness, and positive relationships. “While there may be moments when sacrifices are necessary to pursue career goals, it’s essential to evaluate whether those sacrifices align with one’s long-term values and priorities. Ultimately, achieving success should enhance, rather than detract from, one’s overall quality of life.”

#ThisGirlInvests: Vision For Women In Finance

If there is one thing that drives Oginni in this life, it is the pursuit of gender equality and financial inclusion. Her commitment to addressing Nigeria’s abnormally large gender gap in financial inclusion has rippled through nearly every aspect of UCAML’s operations.

Last year, she launched the #ThisGirlInvests campaign, which went viral on social media, to encourage financial independence and security for women in Nigeria. The campaign aims to encourage women to adopt a healthy investing culture, increase their participation in Nigeria’s capital markets, and develop a long-term financial plan for retirement.

Also, under her leadership, the company re-launched a women-focused mutual fund, The Wealth for Women Fund, to increase women’s participation in the capital market. The fund is dedicated to helping women achieve their financial goals, with a particular focus on long-term objectives such as retirement planning.

Why invest in women? Oginni explains, “For me, being a woman in finance means breaking barriers, challenging stereotypes, and paving the way for greater gender equality and diversity in the industry. It means embracing my unique perspective and contributions while advocating for equal opportunities and representation for women at all levels of the capital markets.”

“My identity as a woman undoubtedly shapes and impacts the capital markets industry in various ways. Historically, the finance industry has been male-dominated, with women facing systemic barriers to entry and advancement. As a woman in finance, I bring a fresh perspective, unique insights, and valuable skills to the table, contributing to a more inclusive and innovative financial landscape.

“Furthermore, my presence in the industry serves as a reminder of the importance of diversity and gender equality in driving sustainable growth and success. By challenging traditional norms and advocating for greater representation of women in leadership roles, I hope to inspire future generations of women to pursue careers in finance and realise their full potential.”

Financial Success Tools

Oginni identified three key tools for success in the industry. She began by stressing the importance of having the right attitude. “Yes, Attitude. Attitude to learn, unlearn and relearn,” she says. “The world of finance is a dynamic world filled with seasons of volatility, market shifts and uncertainty. You need to have the mindset that is open to learning and adapting to the different seasons.”

Secondly, Oginni also stresses the importance of technical expertise. ”Also, get the technical skills. Having a CFA Charter is a great place to start. It opened me up to a world of opportunities in the finance industry.”

Humility, Oginni says, is another crucial attribute for success in finance. “In the world of finance, overconfidence bias has been studied extensively,” she explains. “It is important to always stay humble when looking at investment opportunities and making investment decisions. This is the reason for the caveat: “Past performance is not a guarantee for future performance.”

Beyond these core tools, she offers invaluable advice for young women charting their paths in the industry. “Also, pay attention to your season of preparation. Don’t be in a hurry to sit at the table,” she cautions “The early part of one’s career should be focused on paying the price and making sacrifices for learning and continuous learning. Be the go-to person in your organisation.

“Learn beyond the job that you do. This season prepares you for the career and opportunity that you seek tomorrow but you must pay attention to it and ensure you harness it. That way, when you are invited to sit at the table, you have a better chance of staying there for long.”

Adetola Fasuyi: Sustaining Wealth Through Resilient Into Portfolios

Linda Davis Taylor once said, “Give a woman a dollar, and she can put it to good use. Teach her about how money really works, and she can change the world.” These words perfectly embody Adetola Fasuyi, Head of Wealth Management at United Capital Plc. Her story is a powerful example of what women can achieve when equipped with financial expertise.

Adetola is a highly skilled professional with a wealth of experience in the financial sector, particularly in senior roles focusing on business development and investor relations. Her primary goal is to address the needs of both mass affluent and high-net-worth individuals working closely with clients, offer guidance to help them manage their wealth responsibly, optimise its growth, and sustain it for the lifestyle they envision.

She holds prestigious certifications, including Certified Fellow of the American Academy of Financial Management (FAAFM) and Chartered Wealth Manager (CWM). She earned a Combined Honours (BSc) degree in Computer Science with Economics and an MBA from Obafemi Awolowo University, Ile-Ife. She is also a Fellow of the Chartered Institute of Bankers of Nigeria, an Associate of the Chartered Institute of Stockbrokers, and a member of the Certified Pensions Institute of Nigeria.

Adetola told Guardian Life that “climbing the corporate ladder and reaching the level of head of United Capital’s wealth management business is no small feat. Years of dedication, strategic thinking, and strong leadership have earned me the opportunity for this prestigious role.

“I would say it was divine providence because I initially bagged a BSC in Computer Science with Economics for my undergraduate studies. After graduation, it was my late dad who helped me to secure a job in a bank, thus marking the beginning of a life-changing experience for me, as I had to take up relevant professional certifications to ensure I stayed relevant within the financial service industry.

“I initially started with a commercial bank but later moved into the capital market space following the advice of Mr. Dolapo Atekoja (one of the interim directors appointed by CBN) to steer the affairs of Metropolitan Bank In-liquidation. He advised that I should take the CIS professional exams and I gladly keyed into it and qualified within record time.”

United Capital’s Wealth Management business, under her direction, has witnessed substantial growth with current assets under management in the amount of about N200 billion for more than seven years.

“One of my key achievements in this role is forging strategic partnerships with foreign institutions of repute, thus providing clients with global access to the very best in private banking and capital markets,

“This led to an increase in overall productivity and contributed significantly to the company’s growth. My experience has taught me the importance of balancing short-term operational efficiency with long-term strategic planning to ensure sustainable success for the organisation.”

When asked about investment philosophy, she noted that “At United Capital, we adopt a unique approach to managing wealth on behalf of our clients. We understand that wealth means different things to different people, and we therefore use our collective expertise to help our clients focus on what’s important to them and create an investment portfolio tailored to their circumstances, objectives, and financial personalities.

“Our investment philosophy combines insights from the science of behavioural finance and psychology with modern portfolio management techniques to provide individually optimised performance. By considering the human aspects of investment decision-making, we can gain a more accurate understanding of our client as an investor.

“By looking at every aspect of our client’s wealth from a holistic perspective, we thereafter create a customised portfolio that matches their objectives and financial personalities while maintaining a level of risk with which they are comfortable. And because the entire process is built around our clients’ needs, they can be confident that the resulting investment portfolio will be as individual as they are.”

The future of United Capital Wealth Management, Adetola said, is based on providing unparalleled value to clients while upholding integrity and ethical standards. Her vision includes expanding her reach, providing bespoke financial advice, and empowering clients to achieve financial independence in a global economy.

“In today’s world, wealth management is essential and increasingly global. Affluent and ultra-high-net-worth individuals are looking for the right partner to grow and protect their wealth. At United Capital Wealth Management, this is our strength; with our regional distribution, prestigious experience and clients, we aim to deliver high-quality research and capital market expertise to clients all over the globe.

“Our unwavering focus is to deliver unique value to our clients with global aspirations and we are poised to deliver expert financial guidance and personalised investment strategies that align with our client’s life goals. Our commitment to integrity, client education, and bespoke service offers a superior advisory experience while contributing to the financial security and prosperity of our clients.

“We are dedicated to fostering a relationship of trust where clients feel confident and informed about their financial decisions and aim to empower them with the knowledge and resources to achieve financial independence. Our wealth management business aspires to be a cornerstone in the industry, providing a reliable and ethical approach to wealth management and improving the financial well-being of our clients.”

Adetola amidst her professional endeavours, said she prioritises maintaining a healthy work-life balance, noting the importance of setting boundaries, taking breaks, and pursuing personal interests to recharge and prevent burnout.

“On a personal note, I am passionate about football, so it is a big part of my downtime; I also play table tennis regularly. Most importantly, I like to give back to society so whenever I can, I share my wealth of knowledge in financial services and also general life experiences with young individuals through various speaking engagements and lecturing.”

For women aspiring to thrive in the industry, Adetola stressed that preparation is key and pointed out that understanding the diverse landscape of the financial services industry is also crucial.

“Preparation is more powerful than perfection. As a woman, rather than strive for perfection, you’ll be much better off striving to be as prepared as you can be. I’ve always done my homework and tried to anticipate what might be next. The more planning you do, the more you’ll be successful in both the workplace and at home.

“First and foremost, you must understand the industry. The financial services industry is diverse but can be segregated into many service providers, such as commercial and investment banks, insurance companies, brokerage firms, asset and wealth management planning firms, and so on.

“Once you have a good understanding of the industry, you should then proceed to outline your goals. What do you intend to achieve by coming into the industry? Thereafter, you need to consciously begin to grow your skills. You can identify a mentor who can handhold you in developing the required skills. You must also be prepared to take up some professional certifications to nurture and grow your skills.”

[ad_2]